My guess is that you are on a mission. And the goal of that mission is: To find the best keyword research tool on the market.

First of all: Congratulations!

You recognized the immense potential to generate traffic through a thorough keyword research.

We at SEOintheSUN have been using at least 5 different keyword research tools in the last 7 years but we were always unsure about our choice.

Now in 2018, there are more tools than ever on the market. So we started a new journey trying to figure out which is the right fit for ourselves and our clients.

First, we thought how to do this. Then we took a pragmatic approach: Test them all! And we let them compete against each other and compiled the results in an academic research.

We had many questions and those were our disciplines right there:

- Keyword Suggestions: How many does each tool give us?

- Search Volume: Which tool gives us the highest total amount?

- Relevance: Are the suggestions relevant to the search intent?

- Uniqueness: Did the keywords pop up in several tools or just one?

- Data Sources: Where does keyword data come from and how credible is it?

- Reports and Settings: What are our options in each tool?

- Time: How long does the keyword research process take?

On top, we had two major criteria when looking into each tool. They don’t affect everybody but are interesting for those of you who need to attract international clients.

1) “Can the tool show us aggregated numbers on a global level across all territories and languages?”

Why do we care? Because we get visitors from around the world. Many search in English and we want to target all of them with one single blog post.

2) “How does the tool perform in other countries and languages in general.”

We care because we don’t just operate in one country and need to know what people are searching for in many languages. Especially in our three main ones: English, German and Spanish.

They are also the main pillars of this study as we translated our seed keyword “learn german” into German (“deutsch lernen”) and Spanish (“aprender aleman”).

Actually, SEOintheSUN is a digital marketing school and agency and part of the FU International Academy, a company based in Tenerife (Spain) with a couple of different offers for international clients.

Our global mindset made us take a look at the tools from such an international perspective. But after long hours of research, we still had too many questions unanswered. The content out there just didn’t fully fit our situation.

So we decided to do our own investigation of the topic. What you’re reading right now is the result.

We tell you all about the process we went through to decide which is the best keyword research tool for ourselves. And how to create the right service packages for the different needs of our clients.

Along the way, you’ll get some interesting insights into the tools and their data sources. But for now, let’s get the ball rolling and find you your personal best keyword research tool!

Do you prefer to read it all in one go?

Download Our eBook!

Outline and TL-DR

This post includes affiliate links to tools and products we use and love. If you buy something through those links, we might get some extra coffee money (at no extra cost for you!) which helps us create more awesome posts like this!

By the way.

We know that you’re all busy people and have no time (or interest) to digest an 11,000+ words study for breakfast. Still, we thought it makes sense to give you the full picture with the option to read it all. Or to skip it all. Whatever it takes to find your best keyword research tool.

If you want the get the gist of the matter at once skip to our Too Long – Didn’t Read part. It summarises everything in a 1,800 words conclusion.

Then again, if you’re in it for the long haul, take a look at the rest of our outline. You might notice that we took the good ol’ academic approach.

Don’t worry, you can rest assured that we won’t bore you with any more academic slang. You don’t care about the literature review? No problem, skip to the results or any section you’re interested in most.

In any way, one of our main goals here is to be transparent about our decision-making. Because let’s face it: We’re not almighty and always want to improve our processes. But to do so, we first have to show you how we work.

Along the way, you’ll understand how we designed our SEOintheSUN keyword research services. Or we might also help you to cut through the clutter and choose the right tool for yourself.

To be clear upfront – there are some things that this study can tell you and some that it can’t.

Have a sneak peek at your takeaways!

- Quantitative Analysis: keyword suggestions and search volumes of different tools

- Niche: numbers for broad seed keywords (language school niche)

– “learn german” | “deutsch lernen” | “aprender aleman” – - Data Sources: insights into differences between tools

- International Context: tool comparison for worldwide searches

- Paid vs. Free: advantages of paid tools over free alternatives

- SEOintheSUN Services: insights into our processes

- Features: no comprehensive demonstration of all tool features

- Local Niche: no test with narrow seed keywords for local niches

- Keyword Difficulty: no comparison of keyword difficulty metrics across tools (coming soon)

Still on board? Great.

If you want, take a brief look at the terms in our glossary, buckle up and let’s do this! Figure out your best keyword research tool!

Glossary: Terms and Metrics

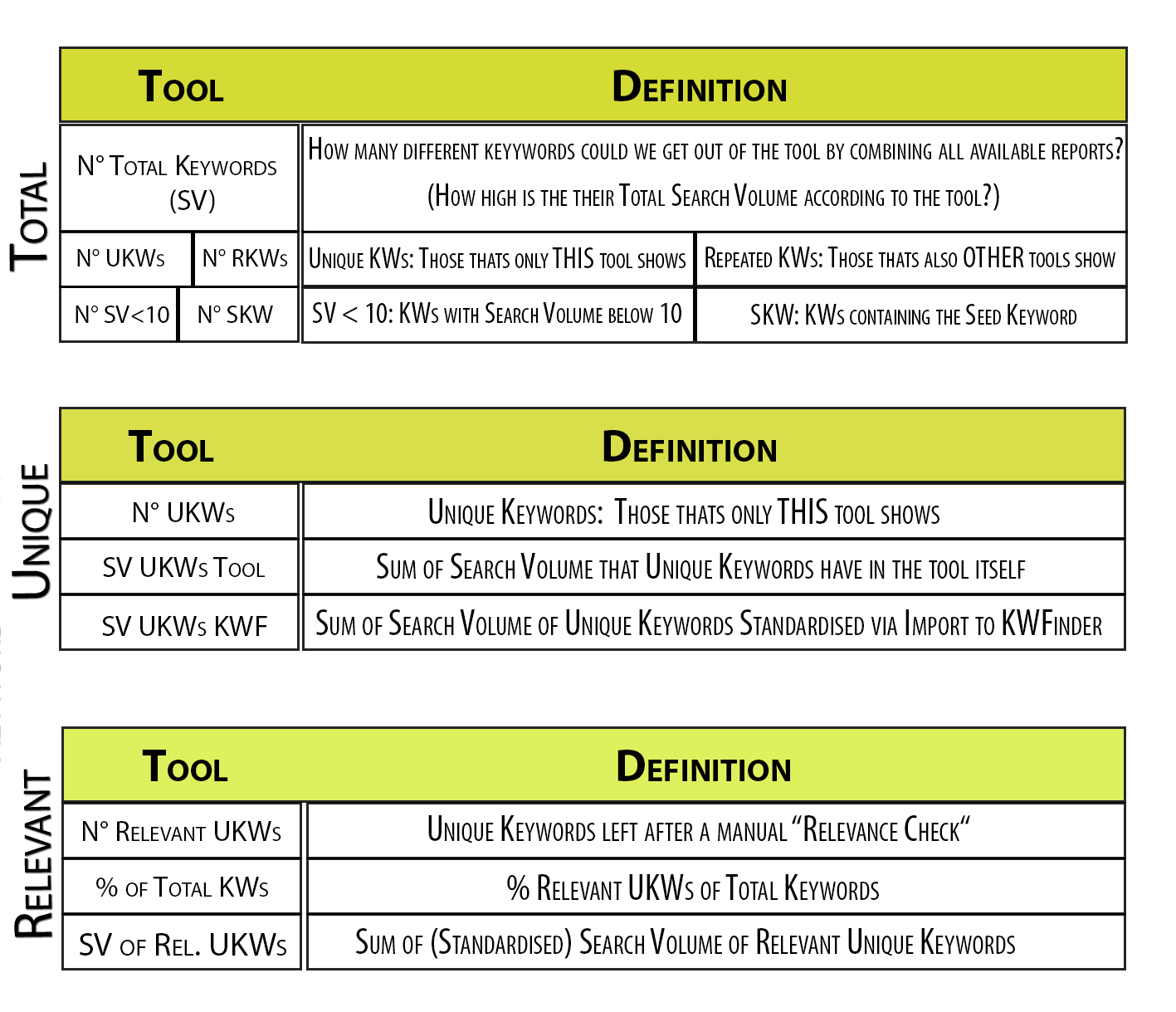

To make your life easier, we put together a little glossary.

Here you find all the terms and abbreviations that you’ll encounter later on.

SV – Search Volume

The number of monthly searches for a certain keyword averaged over the past 12 months.

KW – Keyword

What this study is all about. We are looking for keywords to see which terms people put into Google. The trick is to understand what they actually intend to find with those terms.

SKW – Seed Keyword

The main keyword that you put into a tool to generate further ideas or keyword suggestions. Our seed keywords in this study are rather broad with: “learn german”, “deutsch lernen” and “aprender aleman”.

SERPs – Search Engine Results Pages

The results pages that show up in response to a Google search with a specific keyword. The first SERP includes the pages on the top 10 positions.

TKR – Traditional Keyword Research

A keyword research process that generates new keyword suggestions based on a seed keyword. Suggestions can come from different data sources as e.g. the Google AdWords API.

CKR – Competitive Keyword Research

A keyword research process that generates new keyword suggestions based on the keywords that competitor sites already rank for. Keywords are scraped from the SERP top 10 sites for a specific seed keyword.

API – Application Programming Interface

It basically serves as the intersection of two different software programs and helps them to interact. For example: Some keyword tools interact with Google to source their data.

Google AdWords API

An API that keyword tools can get in order to access Google Keyword Planner data.

Google AdWords

It’s a Pay Per Click advertising service by Google and its main revenue source. It lets you display ads on top of the organic search results.

The ad price is determined via a bidding process.

Organic SEO

It’s basically the opposite of paid advertising via Google AdWords.

You optimize your content in order to rank naturally in the Top SERP positions.

PPC – Pay Per Click

A payment model for online advertising services. The marketer only pays for successful ads. In essence, those that visitors clicked on to get to the landing page.

Close Variant

Close variants of a keyword usually have the same search intention but expressed with slightly different terms, e.g. SEO vs. Search Engine Optimisation.

The Google Keyword Planner combines or “groups” the search volumes of close variants in their metrics.

This way it’s impossible to break down how much search volume comes from which exact term. That’s hassle in content marketing when choosing the focus keyword.

Exact Match

It is usually used in the context of keyword metrics. This means for example that search volumes are not combined for close variants but only shown for the exactly the term that was entered into Google.

Paid keyword research tools like KWFinder disentangle this and show exact match data.

Clickstream Data

Clickstream data basically is all about which websites people visit on the internet and where they click. Tools like Ahrefs and Moz are using it in their models to predict keyword search volume data.

Total KWs – Total Keywords

The number of keywords that are exported from each tool. It’s the direct output without any filters.

RKWs – Repeated Keywords

Keyword suggestions that several tools provide, i.e. those that show up in more than one tool.

UKWs – Unique Keywords

Keywords that are uniquely found in a certain tool, i.e. keywords that only this one tool shows.

Rel. UKWs – Relevant Unique Keywords

Keywords that were left after we filtered the unique keywords for their relevance, i.e. if they actually fit the search intent of the seed keyword “learn german”.

KWs SV < 10 – Keywords with Search Volume below 10

The keywords that have a search volume below 10 in their tool. This metric includes many keywords with no search volume or no available data.

KWs with SKW – Keywords with Seed Keyword Phrase

Keywords that contain the seed keyword phrase. This metric shows if the tools simply add more phrases around the seed keyword or if they find alternative suggestions.

The latter may have the same search intent even if the seed keyword is not included.

Standardised Search Volumes

Each tool provided us with different search volume numbers. To assess the quality of each tool’s suggestions, we imported them to KWFinder and compared this standardized data.

USP – Unique Selling Point

It is the feature or characteristic of a product/service that makes it unique and sets it apart from all competitors. We defined the relevant unique keywords as USP of keyword research tools.

Okay, on to the next part – the literature review.

What does a literature review usually contain? It tells you what’s out there and which analyses other researchers did in the past.

To be honest, good and transparent studies in the SEO field seem to be a rarity. Only the big players appear to have the resources to invest the necessary time and effort. On top, they certainly won’t release everything they’ve got.

And why would they?

Let’s face it: In the end, all keyword research tools are selling a similar software. Why should they reveal valuable insights that they can use to outpace their competitors?

So all that’s left to do for us is to say:

We have a dream…

“We have a dream that one day we’ll have a structured knowledge base about SEO with transparent studies and scientific guidelines.”

Our Dream of a Knowledge Base in SEO

The competition between keyword research tools makes it hard to build a lasting knowledge base as e.g. in academia.

But there are even more obstacles in the way.

Which? Well think about this: As soon as marketers get close to getting a grasp of Google’s algorithm, a shiny new update changes the game.

Ergo: Some previous studies may become irrelevant faster than you think. But they still will linger around the web (it is content after all…) and that makes it hard to be confident about their accuracy.

Another thing to consider:

It might even go against the interests of some SEO providers to be transparent. Publically learning from your mistakes entails admitting them first. So our impression is that SEO studies are often a beauty contest of success stories at best.

Take a look at some of SEMrush’s case studies and you’ll see what we are talking about. Sure, they’re all interesting to read but also often built according to the same schema:

“See how we managed to increase [insert desired KPI] by XY % in XY time!”

Because in the end, even the best keyword research tool needs to keep the marketing engine going. This guest post in the Ahrefs blog sums up the dilemma quite well.

Up next, we tried to gather the ‘State of the Art’ of other interesting articles in keyword research. One major issue here is lacking transparency.

It’s quite hard to find out, how the different tools actually come up with the numbers that they throw at you. We gave it our best shot in the section on the Data Sources of Different Tools. Finally, we’ll introduce you to our Lineup of Competitors and their basic info.

Previous Studies about Keyword Research

There’ve been different kinds of research done in the SEO field so far.

On a macro level, you have the heavyweights like Moz and Ahrefs or SEMrush. They even conduct statistical correlation studies to figure out the most important ranking factors in Google. Or this case study here from the team of Moz which actually shows you well how SEO should be done in 2018.

But since we don’t want to overload you with information, we’ll stick to what our study is all about. Keyword research.

Of course, we didn’t reinvent the wheel here.

We’re not the first ones who thought about comparing the options to find the best keyword research tool. Have a look at some examples of what’s out there on the topic so far.

Firstly, their well-organized overview of SEO Tools was a great starting point. Especially when we tested different free keyword research options.

Beyond that, they even published a guide to keyword research. It includes a review of four of the tools that we also feature: SEMrush, SECockpit, Moz and Ahrefs. It’s a nice comparison to get an overview of their basic functionalities.

SEMrush also took a closer look at some of the tools in our comparison – of course including their own. Fair enough but what’s again missing is a quantitative analysis. What keywords do these tools actually cough up? Are they relevant to your niche?

Check out Authority Hacker by all means.

They did a great job at explaining all the features that keyword research tools offer. Including five of those in our comparison. So if you want to see what exact functions await you in the tools, read through their extensive reviews.

Following Authority Hacker, we also split our analysis in traditional keyword research and competitive keyword research.

“When should you take which keyword research approach?”

The traditional approach only gives you suggestions based on your seed keyword. Ideally, you’re looking for a keyword with solid search volume which is still not targeted by your competition.

This approach is in so far risky as you have no guarantee that those keywords work. But it certainly is the right pick for you if you’re a market pioneer and need to stay ahead of the competition. Or are you a casual/low-frequency blogger? Then it might not make sense to invest money into a competitive keyword research tool.

The competitive approach has the advantage that you spy on the keywords which work for your closest competitors! Based on your seed keyword, the tools check the first results page of Google and its top 10 domains. Then they scrape all the keywords that those domains are ranking for in addition to your seed keyword.

Do you have the same content quality and domain authority (or even better)? Then that’s a solid sign that you should be able to target and rank for those keywords as well.

Finding our perfect combination of keyword research tools. This blog post goes into that direction. It recounts how SEO practitioners actually are using the tools available at their agency.

The main takeaway: There is not THE one best tool. The safest bet is to combine suggestions found in different tools.

Having read these articles, we were still pondering. Which tool should we use for our services on a long-term basis?

Trying to make a choice, it hit us. A mere list of functions and screenshots won’t help us to decide that.

We were still missing something…

DATA and STATS to back our decision!

And that’s what we try to deliver ourselves right here, right now.

So we dove headfirst into the pool of keywords that the tools spit out and tried to tame them with Excel and Google Spreadsheets.

Now. When we speak about data of different keyword research tools, it gets tricky. Looking at keyword metrics, you probably already asked yourself at one point:

Where the hell do these numbers come from?

No worries, you’re not alone. Indeed, at first sight, data sources of the tools appear to be a black box.

We tackled the issue and shed some light on it now.

Data Sources of Keyword Research Tools

First things first.

Before we go any further, it’s time to level the playing field.

We need to clarify some basic distinctions in how and where each tool gets its data. Seriously, for us, the data sources were also the main source of confusion.

All right. Aiming to clear this up, we navigated through the world wide web for information and wrote to all of the companies.

To the best of our knowledge and research skills, there are two main groups of keyword research tools:

Those which source the concrete search volumes directly via the Google AdWords API (KWFinder, SECockpit, KeywordsEverywhere).

Those which combine basic Google data and improve it via third party clickstream data (Moz, Ahrefs).

To get the difference, you need to be aware of the latest developments with Google Keyword Planner.

To put it in a nutshell:

Once upon a time in a land far far away, the Google Keyword Planner was the best option to source search volume data. This made the life of SEOs extremely easy. But that’s already where the fairy tale ends.

Because Google decided to turn the tables on all of us. They tied the access to this data to the amount of money spent on paid advertising in AdWords. Makes sense for Google but sucks for SEOs.

If you have no paid campaigns running, you’ll see only broad data ranges. In essence, they have little value for your keyword selection process.

Let’s face it: After all, it makes a difference if your target keyword has 11,000 or 99,000 searches!

But that’s the only range that Google will show you.

As a matter of fact, that’s why we don’t use Google Keyword Planner and didn’t include it in our comparison. We simply wanted to spend our time and energy on finding its best alternative!

Now. Some tools (KWFinder, SECockpit, KeywordsEverywhere) still have access to the specific search volumes via the Google AdWords API. Yet, that comes with A LOT of requirements that the tools must follow. Take a look for yourself here.

Some users of this API say that this forces tools to be geared more towards Pay Per Click instead of organic SEO.

That of course – again – especially entails one thing: More business and money for Google.

And even if tools put all the requirements in place, they are still at the mercy of Google. If they change the rules of the game, there’s nothing much you can do.

Fancy an example?

There are many Dirty Secrets of Google Keyword Planner. But why do we even care about numbers the Keyword Planner shows if we don’t even use it in the comparison?

Remember that its AdWords API is the principal data source for tools like KWFinder. So you should understand that it could also source potential problems along with it!

Especially one gave us headaches. The grouped search volume of similar keywords (or ‘close variants’).

Grouped search volumes mean for you: More noise in the numbers. You’ll, for example, see two similar keywords like “SEO” & “Search Engine Optimization” with the same search volume (100 K – 1 M). That’s not just a coincidence!

Chances are that Keyword Planner merged their search volumes. In essence, it shows the total volume sum of both keywords plus any other ‘close variants’. But you’re lacking information on which keywords are included in this data range and what their precise volume is.

Confusing? Yep! Intransparent? Exactly.

That’s the case because the Google AdWords search volumes are for Pay Per Click marketers. When they bid on keywords, their ads will also show for all close variants. So it makes sense that they see the merged search volumes when setting up campaigns.

In SEO however, each close variant keyword will show different SERPs. Thus it would be useful to have the ‘exact match’ search volumes for each term.

Lucky us. Why? Because KWFinder provides this exact data. This way, we were able to check the quality of the suggestions from different tools. We simply ran them through KWFinder to standardize and compare their search volumes.

To avoid inflated numbers, we made sure to clean all cases when we still suspected combined data. We simply took any merged volumes that showed up more than once out of the equation.

On top, we decided not to count the search volume of keywords with typos. Unlike for paid ads, it doesn’t make sense to optimize for typos since, usually, you end up with the same SERP anyway due to Google Autocorrect.

For us, it’s not surprising that the big players want to be independent of these kinds of shenanigans. Moz and Ahrefs rather calculate their data independently. They claim to take Google’s numbers as a basis only to improve it with third-party clickstream data from providers like Jumpshot.

But that’s already getting deep into the statistics jungle. So we’ll leave it at that for now.

If you’re keen on decoding the topic even further, look at this article for more insights on how to set up Google’s API. And guess what – even on Reddit you can learn more about keyword research. In this post, the team members from different tools joined a discussion about data accuracy.

For everybody else, it’s time to meet the contenders of our little contest!

Introduction to Competitors

Here we go: The playing field is leveled.

Now we have an idea of what goes on behind the scenes of each tool and a standardized way to compare the performance.

Time to introduce the players themselves!

In this study, we compare five paid keyword research tools as well as one combination of free tools.

Like we mentioned before: We focus on keyword outputs. Many of the tools have a wide-range of other functionalities. If you want a full review of those, don’t forget to check out Authority Hacker!

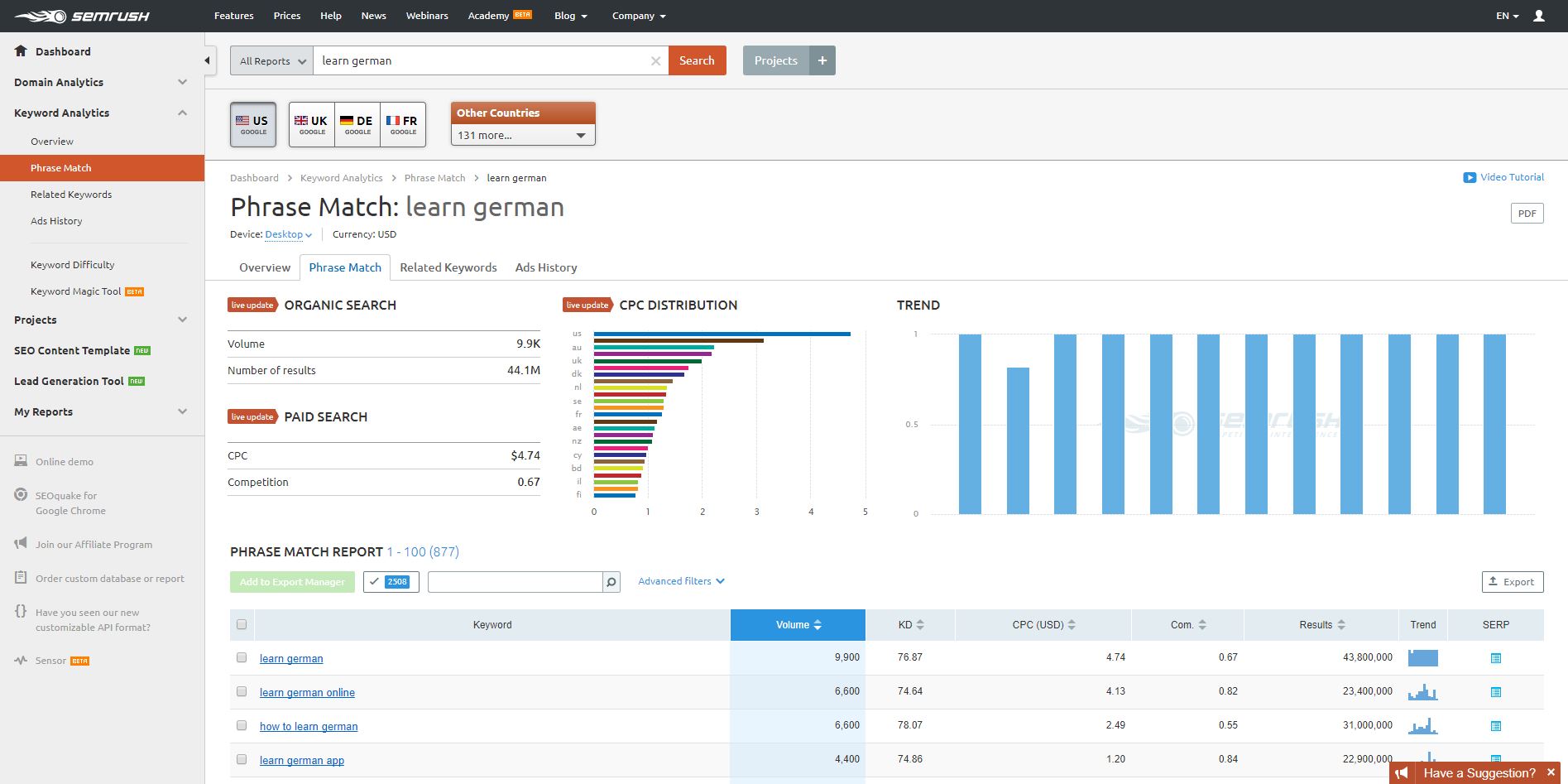

SEMrush

First up is SEMrush, a tool that we’ve already been working with for a while in the past. Now it was time to ask the question:

Is it worth the subscription when comparing the outputs with other tools?

SEMrush works with national databases, so results are on a country-specific level.

According to them, their keywords are publically available (first 100 Google search results). Also they say to collect the data similarly to Google Keyword Planner.

We got in touch with them about where the data for their search volumes comes from. The final answer that we got was sadly vague. But we were positively surprised by the fast correspondence back and forth with the SEMrush team:

“The volume is also estimated using our algorithm. Sadly, this is as much as I can reveal :)”

High volume keywords get a more frequent (daily) update than low volume keywords (monthly). Further, they admit lacking local keywords since they collect data on a national level.

Since SEMrush works with national databases, you can only search on a country level. Besides, you can select between desktop and mobile databases.

One main metric in our case study is search volume. SEMrush defines it like this:

“Volume”: “The average number of times users have searched for a given keyword per month. We calculate this value over the last 12 months.”

What options does SEMrush offer for your keyword research?

It actually gives you three reports for traditional keyword research:

(1) Phrase Match Report, (2) Related Keywords Report, (3) Keyword Magic Tool. (Update: The three tools have been consolidated within the Keyword Magic Tool).

We used them all and removed any overlapping keywords.

You can also do competitive keyword research. With the Organic URL Research of SEMrush, you’re extracting keywords that your competitors rank for.

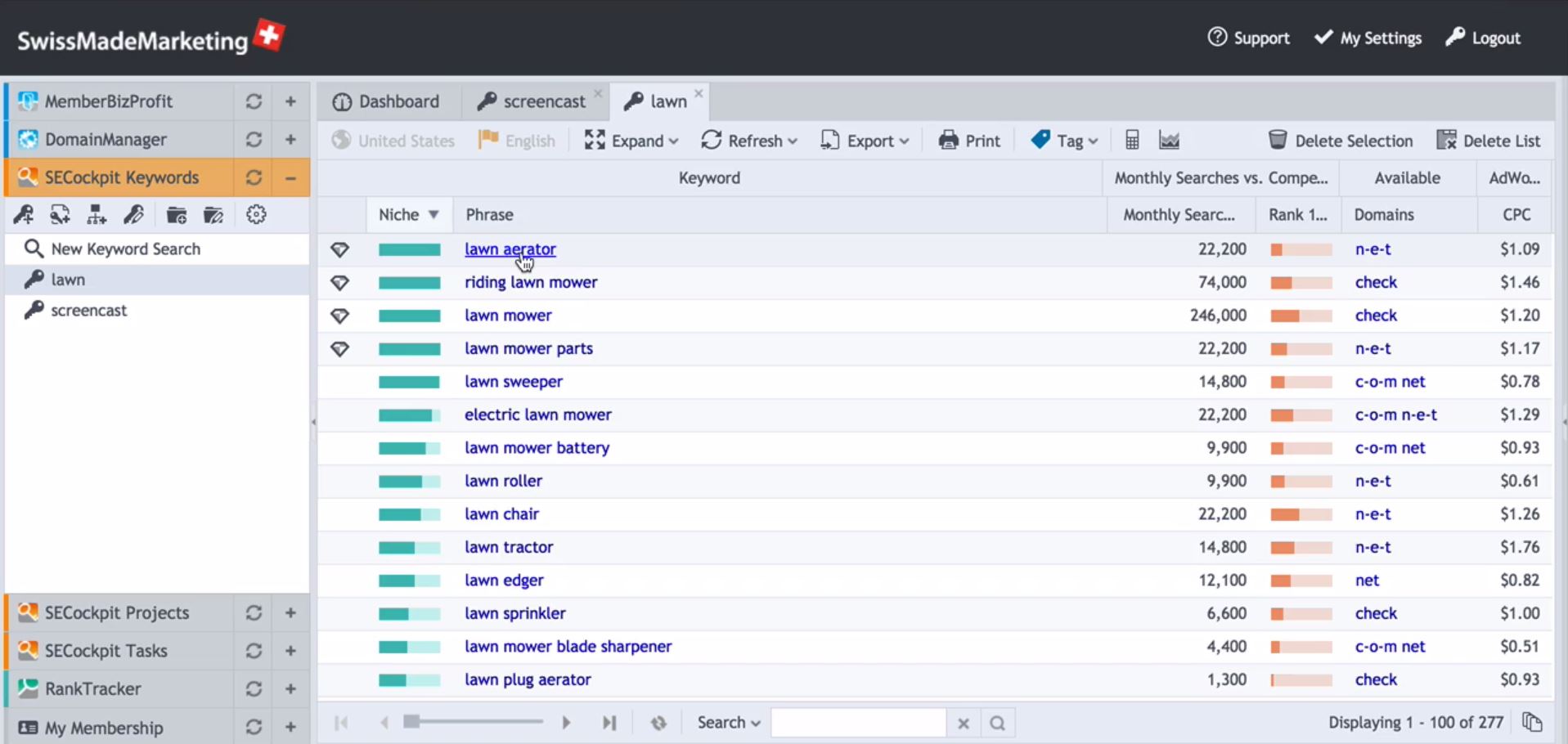

SECockpit

SECockpit was our second tool choice before starting this comparison.

It’s cloud-based and scrapes its data live from several sources, including e.g. Amazon or Youtube. It claims that it does so faster than other tools and with a better keyword difficulty score. Take a look at the developer’s comment to this post for some insights.

Unlike SEMrush, SECockpit has no own databases. They scrape all data live from APIs like from Google AdWords. Differences in the numbers with e.g. Google Keyword Planner can occur since the data is cached for 30 days.

SECockpit prides itself on delivering unique metrics for all sorts of SEO strategies. It’s true that you can choose from an immense list of metrics.

One thing that’s highly important for us, is the option to look for those metrics on an aggregated global level. This is only possible with half of the tools in that we were looking into. SECockpit is one of them.

Their definition of search volume also is straightforward:

“Monthly Searches”: “Monthly Searches based on the data from Google Keyword Planner.”

What options does SECockpit offer for your keyword research?

You basically get two types of keyword reports:

A traditional (1) “Keyword Phrase” report based on a Seed Keyword. And a (2) ”Website” report where you can scrape keywords from (your competitors’) URLs.

Your results can always be easily extended via the “expand list option”.

When conducting the competitive analysis for the SERP top 10 it took us quite a while, around 30 minutes. So it goes without saying that SECockpit doesn’t operate at the warp speed that it advertises with.

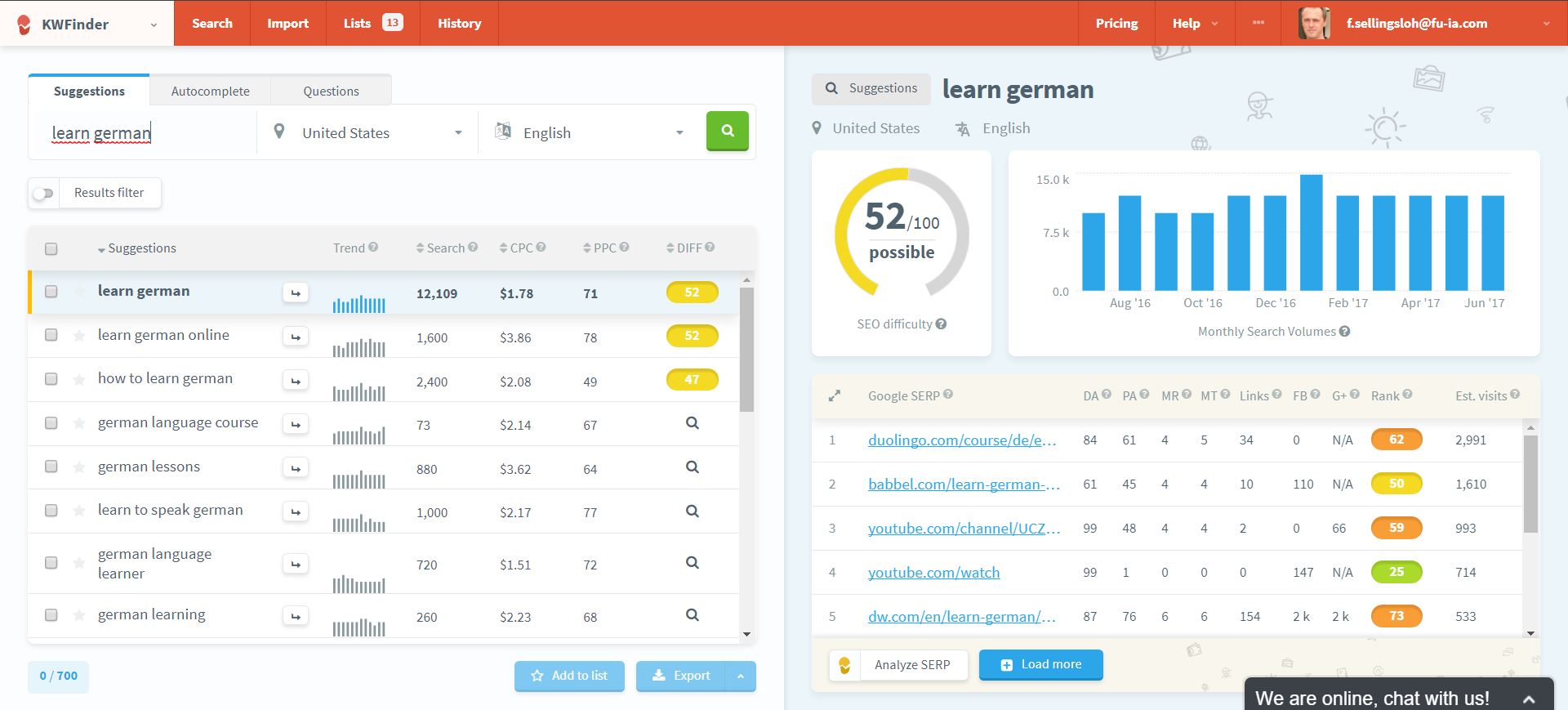

KWFinder

KWFinder is one of the newer players on the market and convinces with its simplicity. It has a well-arranged user interface that shows the most important metrics in one go.

It clearly has the potential to play in the big leagues soon if it keeps going at the same pace.

KWFinder uses the Google AdWords API and claims to display precise search volumes. Without merging close variants. It definitely is a smooth alternative to Google Keyword Planner.

KWFinder strikes the perfect balance for us:

Exactly the right settings we need with no information overload.

You can search on a global level and will get a nice overview of metrics as well as a SERP analysis – all on one screen. Their definition of search volume is:

“Search”: “Average monthly search volume (exact match) in the last 12 months.”

What options does KWFinder offer for your keyword research?

You get three types of keyword reports from KWFinder’s Google AdWords API: a general (1) “Suggestions” report, (2) an “Autocomplete” report and a (3) “Questions” report.

On top, we heavily used the “Import” function where you can upload up to 700 keywords (200 with the Basic Plan). It was crucial for us to check all keywords in one and the same tool. This way we were able to standardize the search volumes of the suggestions that all the tools spit out.

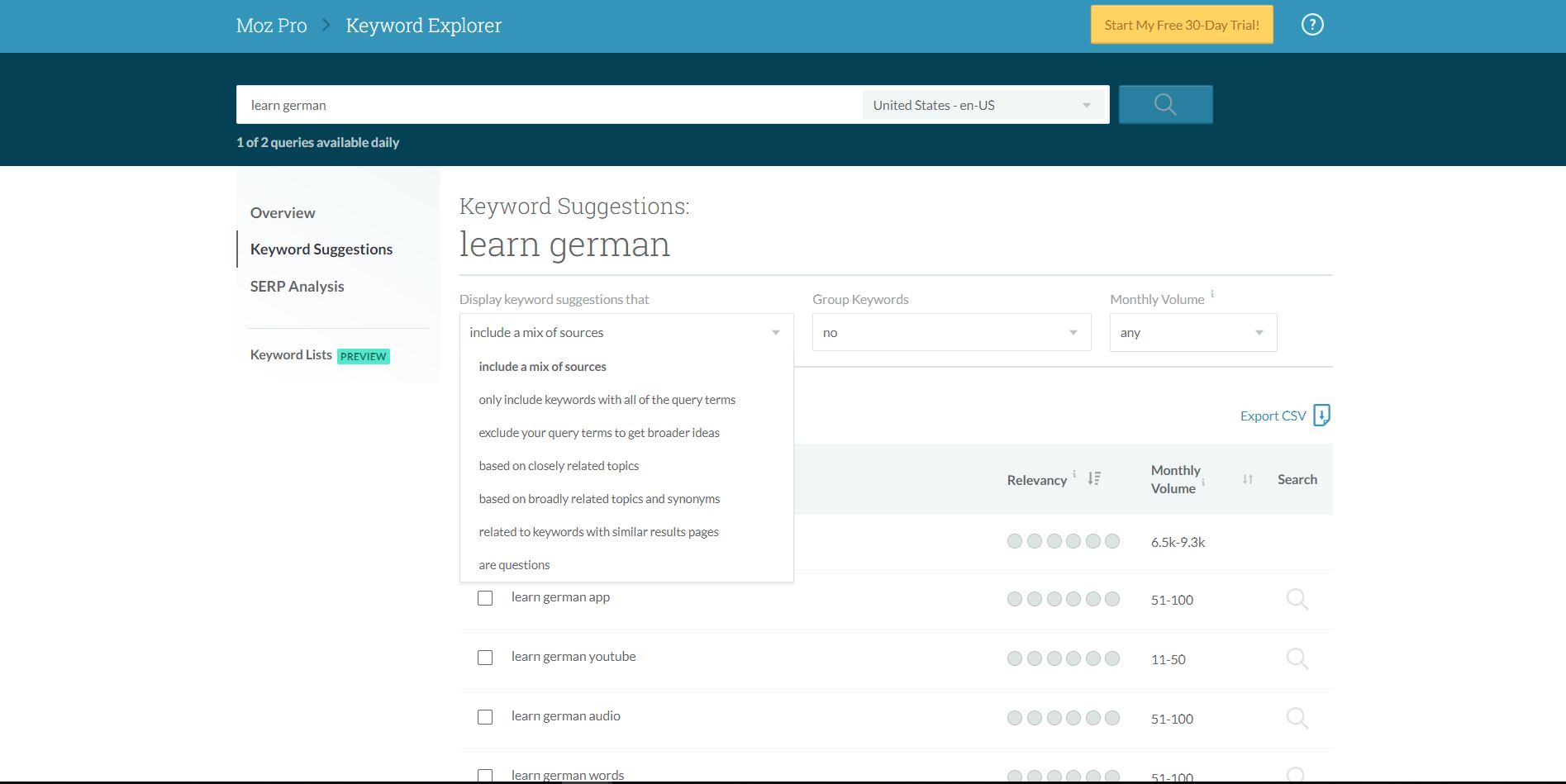

Moz

Next up one of the big players in the business: Moz and its Keyword Explorer.

They stepped up to their reputation in the industry and came out with it in the middle of 2016. So it’s a quite new tool.

To be honest, we were really intrigued by it and excited to give it a go. Just take a look at the introductory blog post and the pitch deck. And you’ll definitely understand where our high expectations were coming from.

As touched upon, Moz is merging Google search volumes with clickstream data. With their own algorithm, they transform the grouped Google data buckets into more realistic data.

But. (Of course, there is a but.)

The output that you get as user again comes in ranges. They may be statistically more accurate than those of the Google Keyword Planner and solve the ‘close variants’ issue.

But still: They’re unhandy to work with. At least in our humble opinion.

In addition, many of the suggestions show no search volume data yet.

And besides this, the most important drawback from our point of view: It only works well for keyword research in the United States.

Read for yourself:

“Thus, while the tool can search any Google domain in any country, the volume numbers will always be for US-volume. In the future, we hope to add volume data for other geos as well.”

The settings are on a country-level but remember: While you get international suggestions, the numbers will always be from US data. Their search volume definition:

“Monthly Volume”: “Volume ranges show you (with 95% or more accuracy) how often a term or phrase is searched for in Google each month.”

What options does Moz offer for your keyword research?

The tool offers seven types of reports that…

- “include a mix of sources”

- “only include keywords with all of the query terms”

- “exclude your query terms to get broader ideas”

- “are based on closely related topics”

- “are based on closely related topics and synonyms”

- “are related to keywords with similar results pages”

- “are questions”

Full disclosure:

We already knew upfront that the data for German and Spanish queries won’t be accurate. So we saved ourselves some trouble and only extracted the first report for “deutsch lernen” and “aprender aleman”.

For the English seed keyword “learn german” we, of course, downloaded all seven available reports.

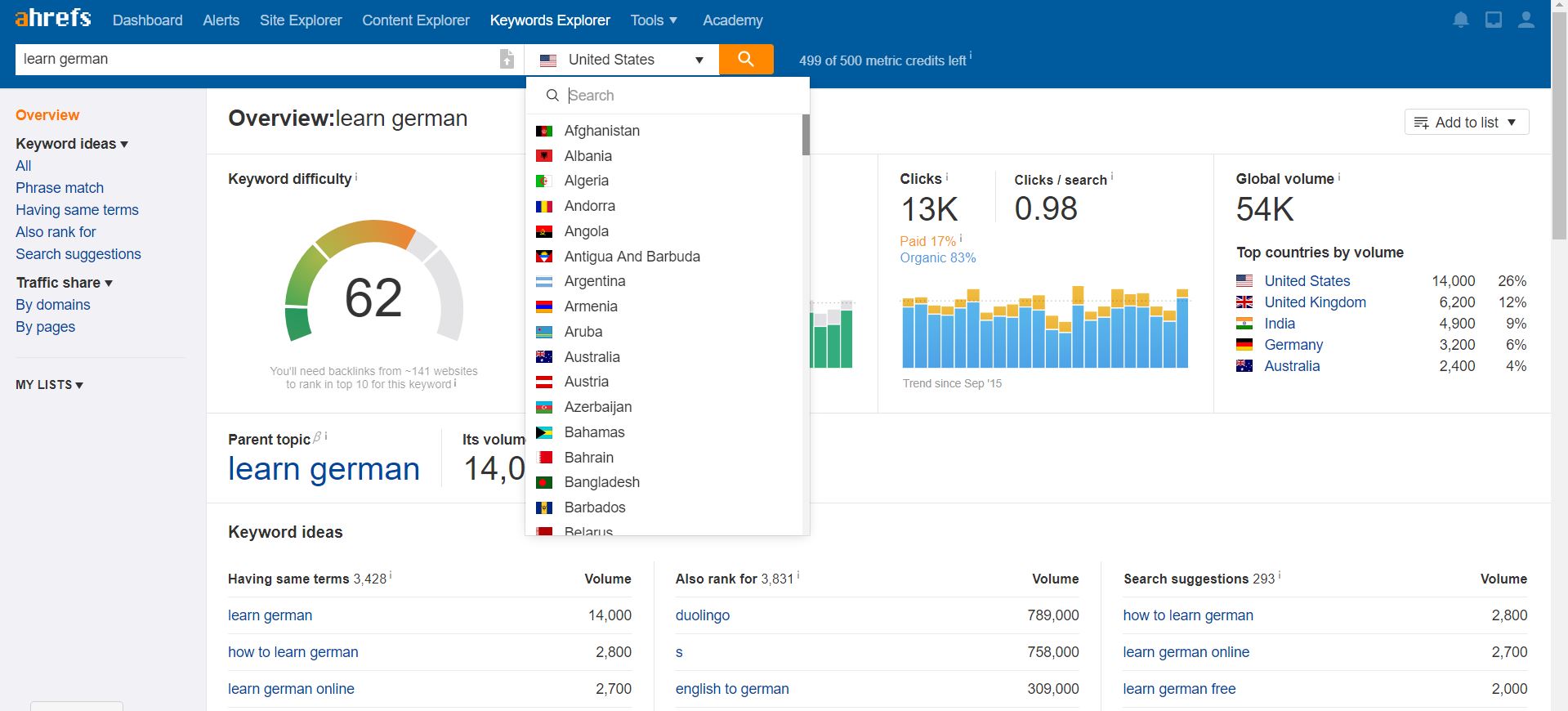

Ahrefs

Ahrefs is the other heavyweight in the world of SEO tools besides Moz and SEMrush.

But we have to say that it *spoiler alert* has a more advanced keyword research tool. At least speaking of data availability and user experience.

What impressed us most is, that it’s basically a one-stop-shop: If you search for a keyword, you can download all available reports in an already aggregated list. Including a SERP top 10 competitive analysis! Remember that in SECockpit and SEMrush it takes you about 30 minutes to do that.

Ahrefs and Moz seem to be the only tools in our comparison that actually improve Google volumes with clickstream data. The difference: Ahrefs does so with a database that supports 100+ countries. So since it does not use US search volumes for international queries: Ahrefs scores again!

Like SEMrush and Moz, Ahrefs operates on a national database level.

This again means that the limited search settings – one country per search only. They define search volume like this:

“Volume”: “search volume shows how often a target keyword is searched per month in a given country (average for last 12 months). We calculate this metric with exceptional accuracy by processing large amounts of clickstream data.”

What options does Ahrefs offer for your keyword research?

The aggregated “All” report is a combination of four single report types:

For the traditional keyword research, we got the (1) “Phrase match”, (2) “Having same terms” and (3) “Search suggestions”. For the competitive keyword research, we downloaded the (4) “Also rank for” report.

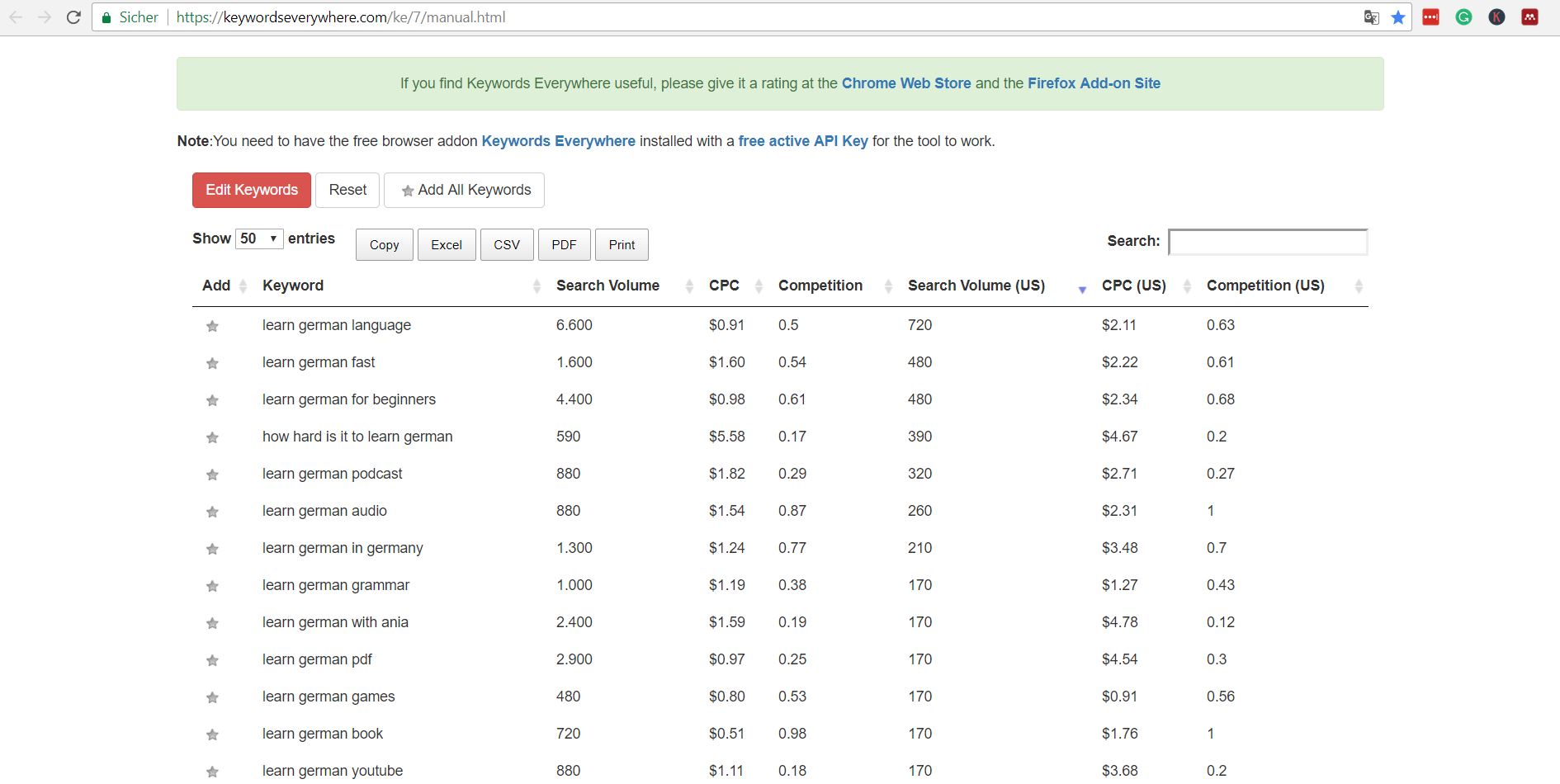

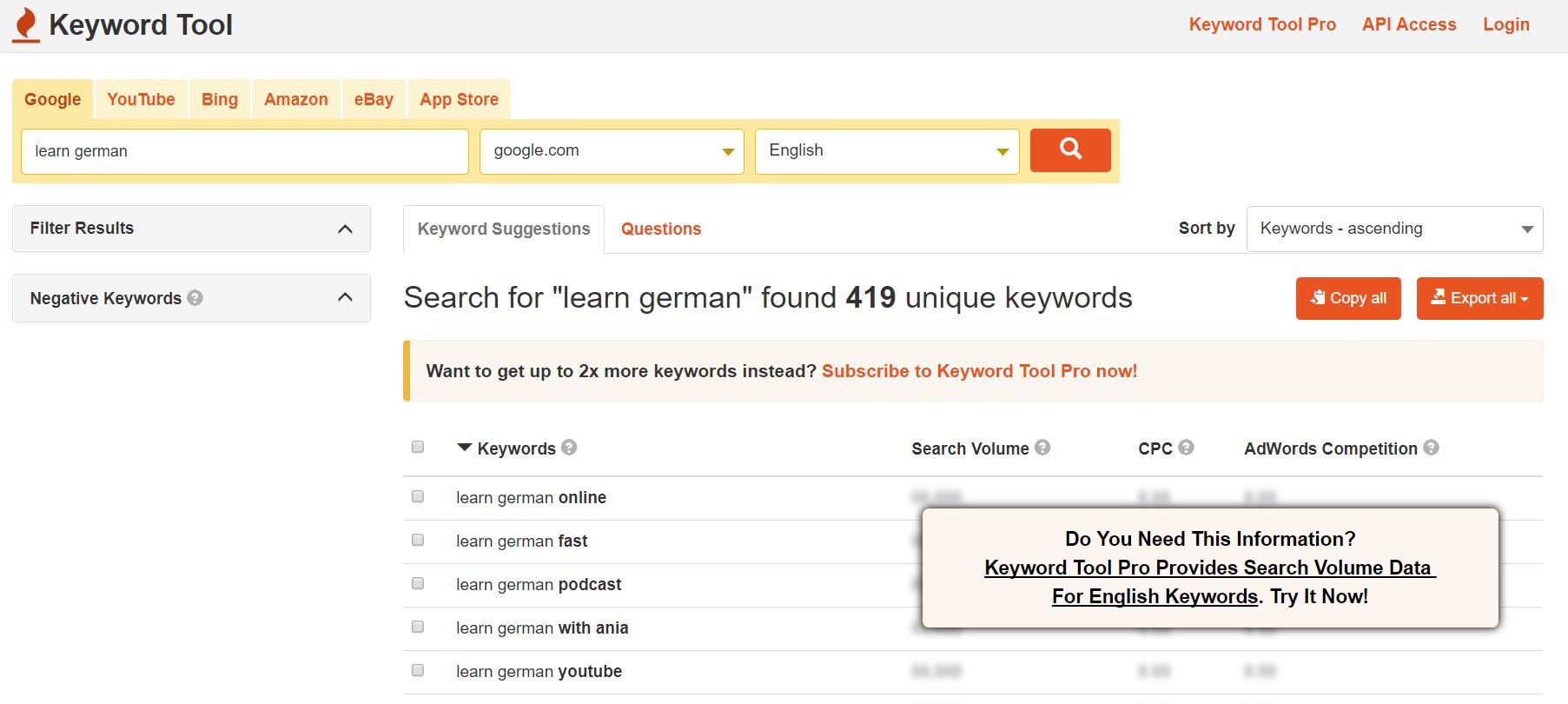

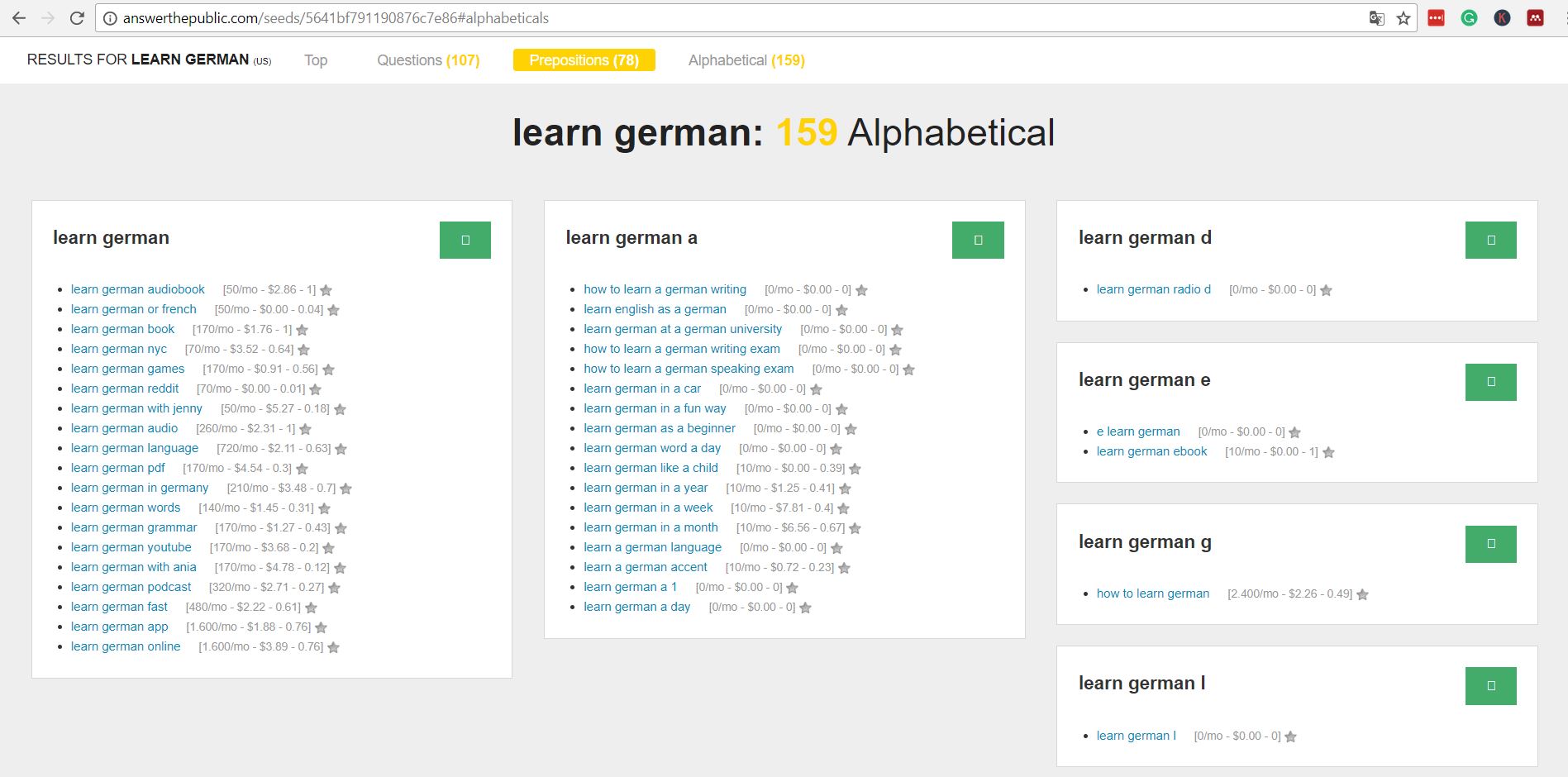

Free Tools

Free Tools… sounds promising, right? Because let’s be honest:

Why should you pay a fortune to use those paid tools that we introduced if you can get the job done for free?

The same question intrigued us.

So we tested all the suggestions for free keyword tools from backlinko.com. At first sight, there seem to be many fishes in the sea. But then we checked the search volumes for their suggestions in KWFinder. Only to find out that most of them were next to nothing.

In the end, we decided to go with a three-step approach to our free keyword research: Generate suggestions in

(1) www.keywordtool.io plus (2) www.answerthepublic.com and import to

(3) www.keywordseverywhere.com to get the search volumes.

The search volumes that you can extract from Keywordseverywhere.com also seem to come from a Google AdWords API.

A major disadvantage is – again – a huge bias towards English keywords. Try importing keywords with Spanish/German characters like “ñ|é|ä|ü|ö”. Keywordseverywhere.com will give up and not provide any data whatsoever.

In Keywordseverywhere.com you actually have the possibility to do a worldwide search for keyword volume data. On a country basis, you can only choose from different English speaking countries.

There is no specific definition of their search volume metrics. But we assume that it’s the regular monthly average over the past 12 months.

In the end, we extracted the suggestions from two websites: Keywordtool.io & Answerthepublic.com

Keywordtool.io actually allows you to copy any suggestions to your clipboard. This way you can easily import it into the Keywordseverywhere.com extension. For Answerthepublic.com suggestions you will need to download the excel outputs first.

Okay. So all the tools had their chance to shine. We have all their reports.

What’s next? How did we actually organize and analyze it?

That’s what this section is all about. We’ll tell you which assumptions we took and how we conducted our analysis based on them.

All in all, we wanted to take the most structured approach possible to find our best keyword research tool.

Assumptions and Limitations

Judging the quality of keyword tools with one quantitative study is complicated. After all, one thing is clear: You choose your final target keywords depending on your niche and business.

It’s you who hand-picks the most relevant keyword for your content needs. How can we possibly analyze that on a larger quantitative scale?

We dropped the gloves and gave it our best shot. To do so we made three main assumptions about our:

(1) Seed Keywords | (2) Unique Keywords | (3) Relevant Keywords

We wanted to stay in the language school niche but not serve a ready-made analysis to our Spanish school competitors.

So we decided to go with the seed keyword “learn german”. A convenient choice as the Germans in our team easily could check the relevance later on. Translated into German and Spanish we get: “deutsch lernen” as well as “aprender aleman”.

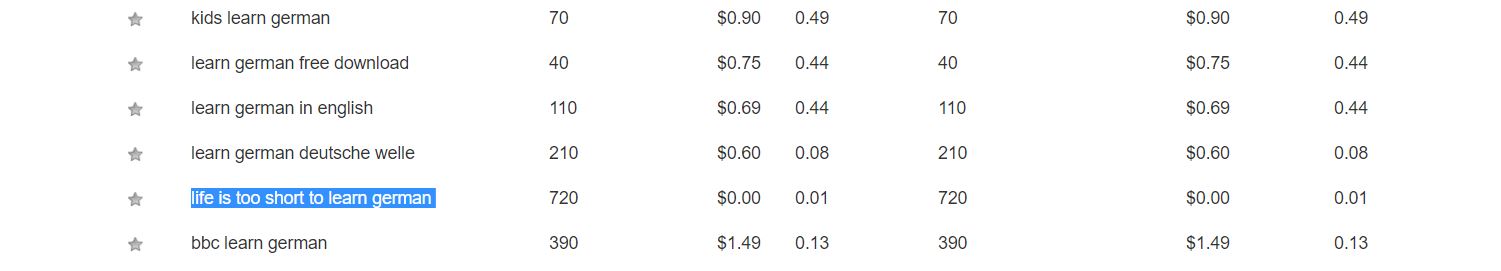

By the way. We took this keyword although 720 people worldwide clearly have the opinion that learning German isn’t relevant at all…

Anyway. Let’s be serious again.

In fact, those seed keywords are quite a heavy assumption to make. Odds are that a more narrow keyword might be a game changer when looking at the results of this comparison!

But let’s not get ahead of ourselves. We’ll look into that in our next study.

Here’s a term that you should remember by for the next few minutes: relevant unique keywords

For us, it’s reasonable to assume that the unique selling point of each keyword tool is their unique keywords.

Because let’s face it: You can get the basic keyword suggestions from most of the tools. But can they also suggest you that one unique keyword that gives you a competitive edge?

That’s why we decided to filter the outputs and focus our analysis on those unique keywords:

- How many does each tool provide?

- Are they relevant to in relation to our seed keyword (“relevant unique keywords”)?

- And how high is the search volume of those relevant unique keywords?

You might disagree with this approach. But for us, it’s the best proxy to analyze and compare the value of keyword suggestions on a larger scale.

While checking the relevance of our unique keywords, we quickly realized one thing. Quantity isn’t everything. At least not the number of the initial keyword outputs.

Full disclosure – again:

We were quite generous in judging whether keywords are relevant or not. As long as they remotely had to do something with learning German, we included them. Here’s an example from SEMrush: relevant = “speaking german” | not relevant = “how to speak efficiently”. And another one from Moz: relevant = “german dictionary” | not relevant = “google translate”.

Going through ~25,000 unique keywords was quite an extensive undertaking. So there may be some keywords that we judged relevantly and you wouldn’t have. But those individual cases shouldn’t distort the general trend of our data overview.

In any way, our ‘relevance check’ focused on selecting a pool of keywords related to the topic of learning German. In the end, each business is different and targets different search intentions. This means that they will also choose entirely different keywords.

Still, think about it: It doesn’t hurt to have a big pool of potentially relevant keywords at your fingertips to select from!

Wouldn’t you agree? And that’s exactly what our quantitative analysis focused on.

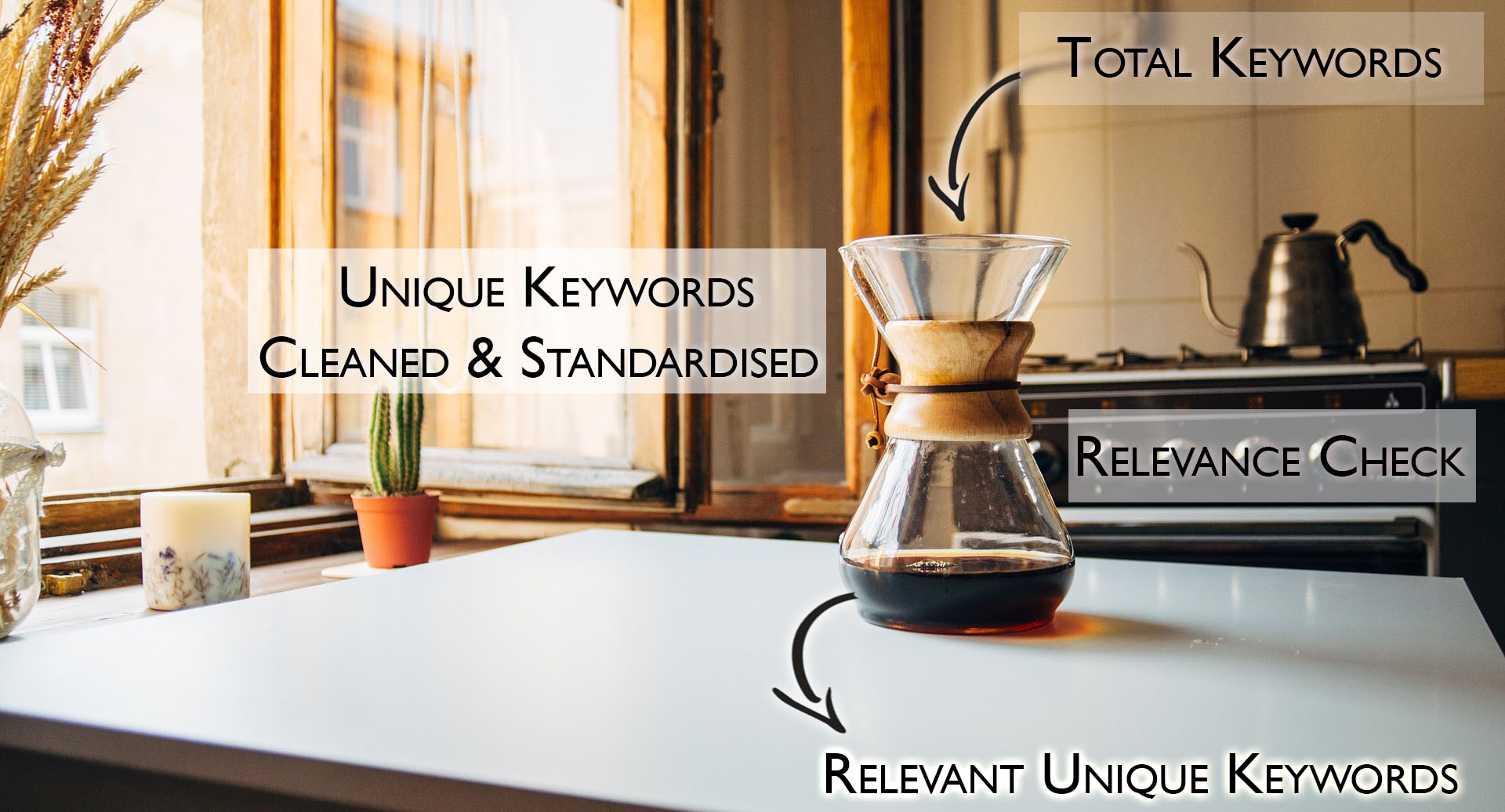

Like our set of assumptions, our analysis process had three steps:

1) Total Output: Analyse ‘raw data’ of keyword suggestions.

2) Tools’ USP: Analyse only unique keywords with standardized search volumes.

3) Keyword Quality: Analyse only relevant unique keywords with standardized search volumes.

One thing we can say: It’s interesting to separate the wheat from the chaff and see how the performance of each tool changes.

To be honest: Keyword data is a mess.

And from what we’ve read, that’s the common stance across the industry. So it seems like mission impossible to make a quantitative comparison between tools.

Still, we think we made it.

Data Collection: Report Guidelines

Our first step to make the data as comparable as possible was to give ourselves clear guidelines. Which data from which reports would we like to compare?

First, we always did choose the following settings (language & country) where possible.

- learn german: English & United States

- deutsch lernen: German & Germany

- aprender aleman: Spanish & Spain

- Device (where possible): desktop

Then we gave each tool its own “chance to shine”.

We extracted keyword suggestions from all the reports we could get our hands on. Of course, if there were overlaps between the reports, we removed all duplicate keyword suggestions in Excel or Google Docs.

In the end, each tool entered the ring with its own list of distinct keyword phrases.

Following the approach of Authority Hacker, we split our analysis into two main categories:

(1) traditional keyword research and (2) competitive keyword research.

The reason is straightforward:

Tools without competitor based reports would be at a huge disadvantage. The sheer quantity of keyword outputs alone would’ve distorted the results.

Especially when you consider that any and all keywords are scraped from the competitor sites – relevant or not to the search intention behind the Seed Keyword.

Data Analysis: Filter and Metrics

Let’s dive into the data. How did we organize it?

To find our best keyword research tool, we decided against statistical software like SPSS because we were only looking to do a descriptive analysis (no correlations or the likes). Excel and Google Sheets are perfectly fine for that purpose. Besides the formulae and formatting options made it easier to keep an overview over all the data.

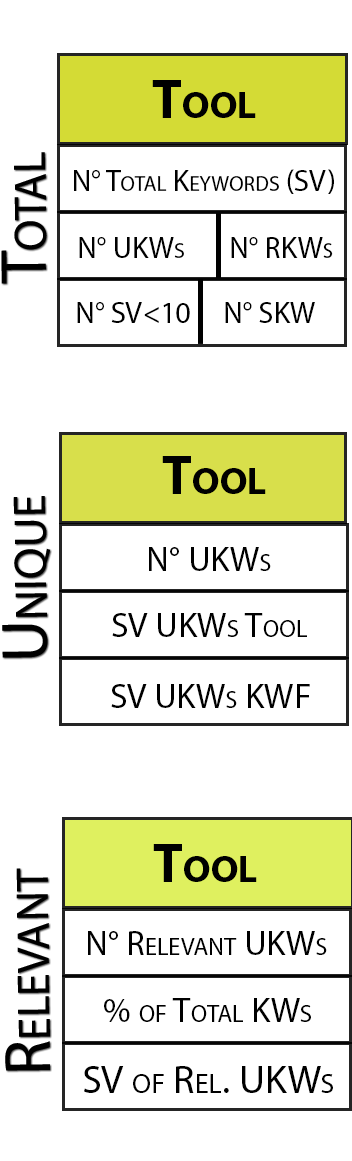

With the end in mind, here are the metrics that we came up with to compare the tools. We applied them to both, the traditional and the competitive process.

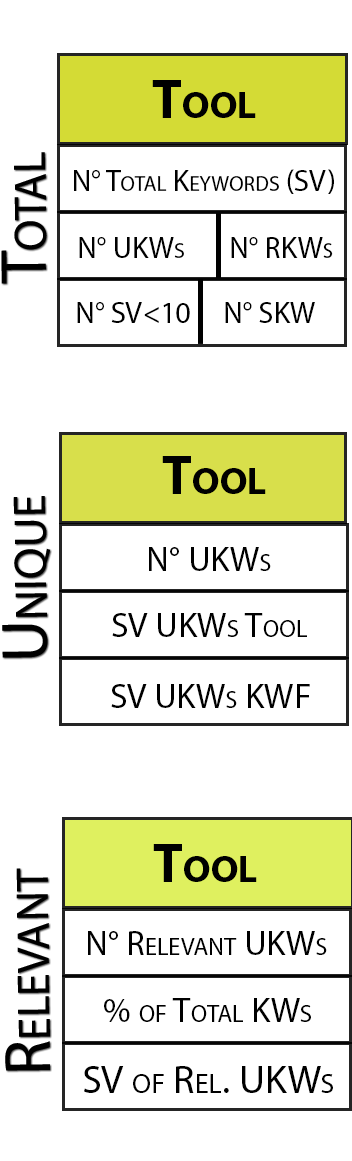

To put the graphic into words…

In the 1st layer of analysis, we just looked at the superficial outputs of all tools: their total keywords.

- How many do they suggest?

- What’s the total search volume along with that?

- Of the total keywords, how many are unique in one tool and how many are repeated in several tools?

- Are there many suggestions without or little data (search volume below 10)?

- Or do they merely expand the Seed Keyword (“learn german” → “learn german fast”)?

It’s basically the first impression that you’ll have after plunging in your seed keyword or its corresponding SERP top 10 URLs. The only problem: You probably agree from experience that first impressions often are deceiving. Of course, we didn’t settle for that.

In our 2nd layer of analysis, we singled out the USP of each tool: its unique keywords.

- How many does each tool suggest?

- What’s their total search volume?

- How high is their standardized search volume, i.e. after we import the unique suggestions to KWFinder and clean for merged data?

Now we know how creative tools are in coming up with keywords with a competitive edge.

Now the final step. It’s like the World Cup trophy in football or the Olympic gold medal in athletics. It’s the holy grail of keyword research: relevance.

The 3rd layer of analysis was there to dissect the unique suggestions even further and check if they are relevant.

- How many Relevant Unique Keywords does each tool suggest?

- Going back to the top: How many % of Total Keywords do they represent?

- How is their final (Standardised) search volume?

Remember: In our opinion, relevant unique keywords metrics are the best proxy to compare the quality of each tool’s output objectively on a larger scale.

But now without further ado, we’ll proudly present the one and only:

Alright. Tensions are rising.

Now we’ll walk you through the most striking results of our little competition. And yes, we’re talking about…

Quantitative Results with DATA and STATS

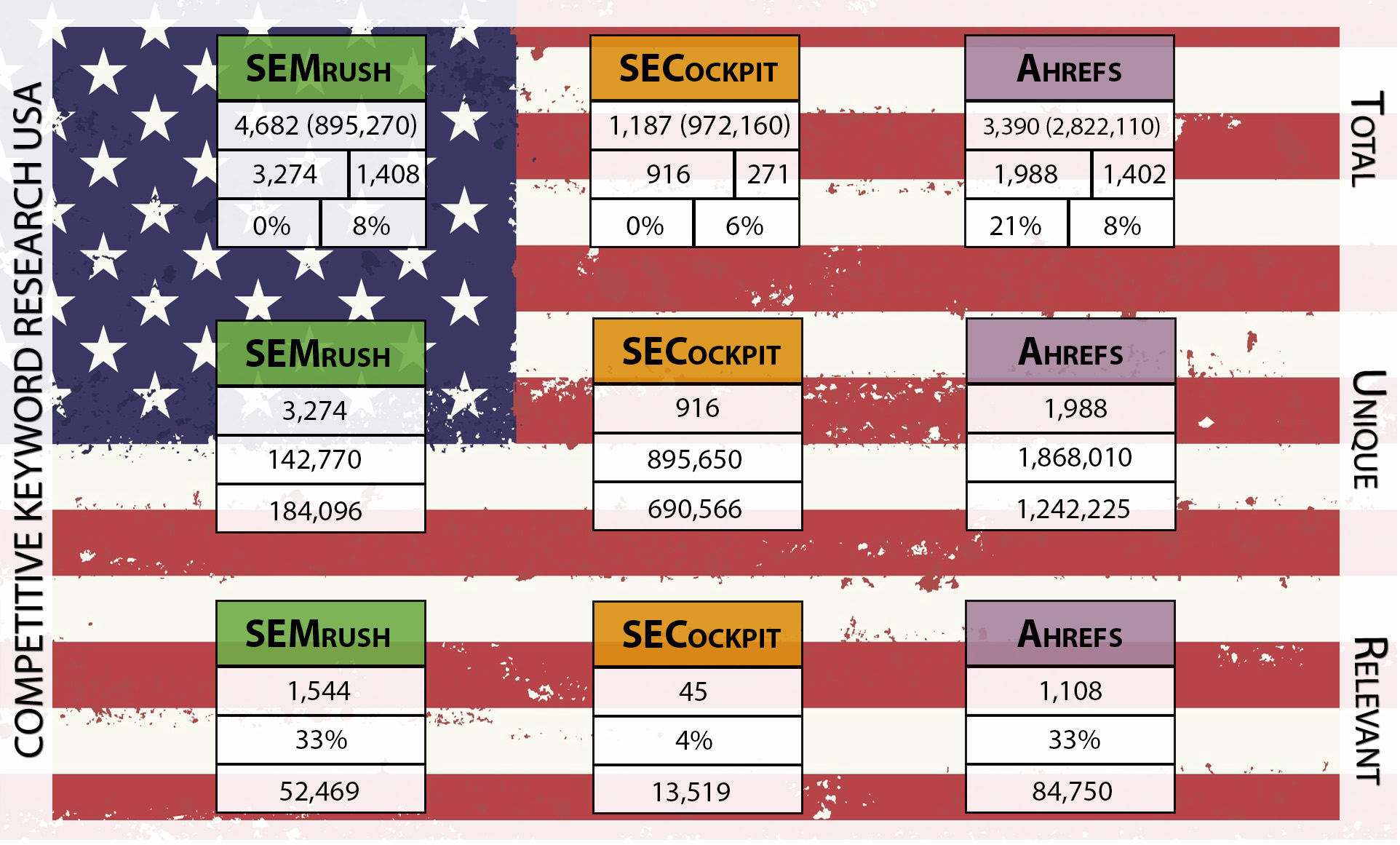

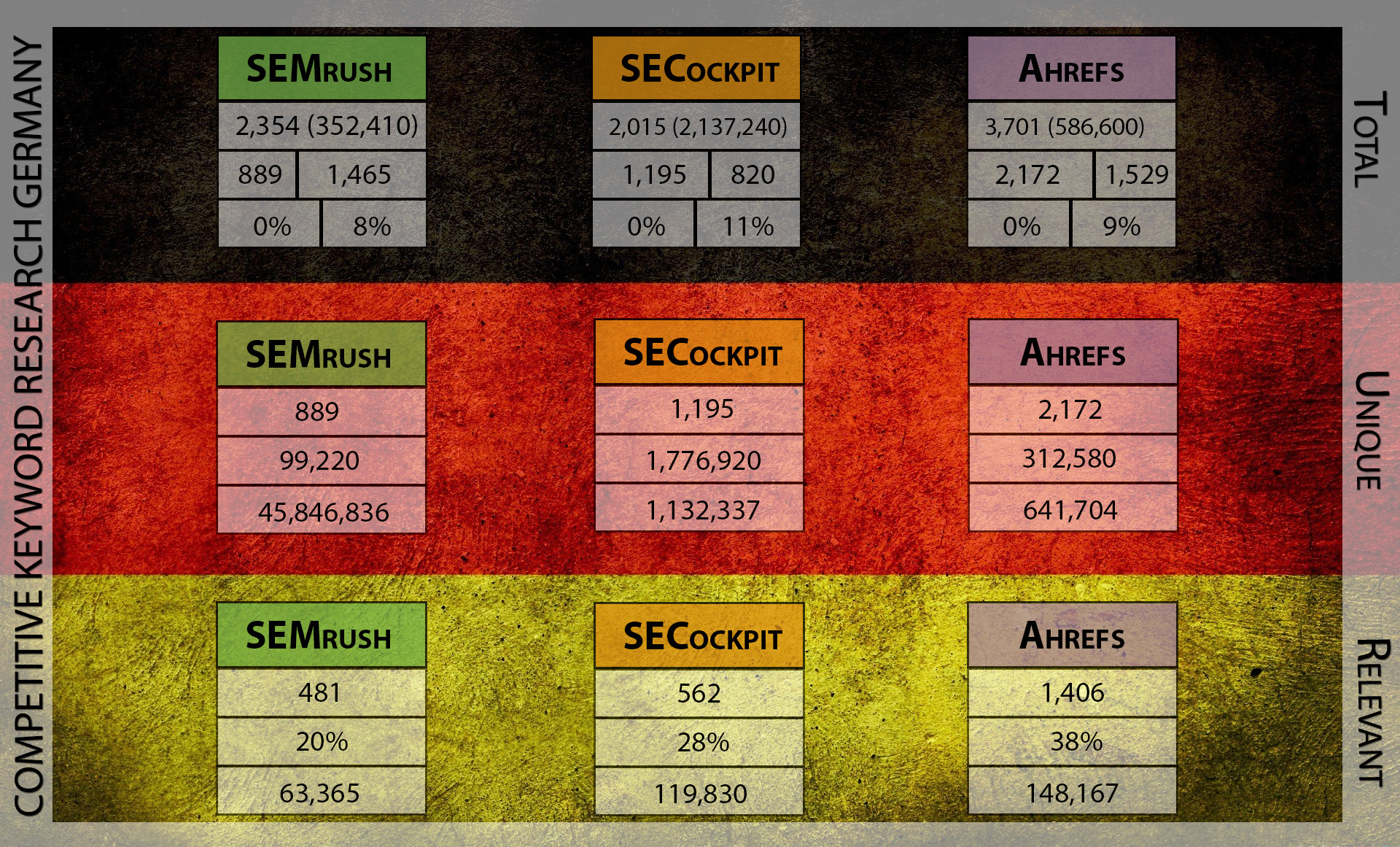

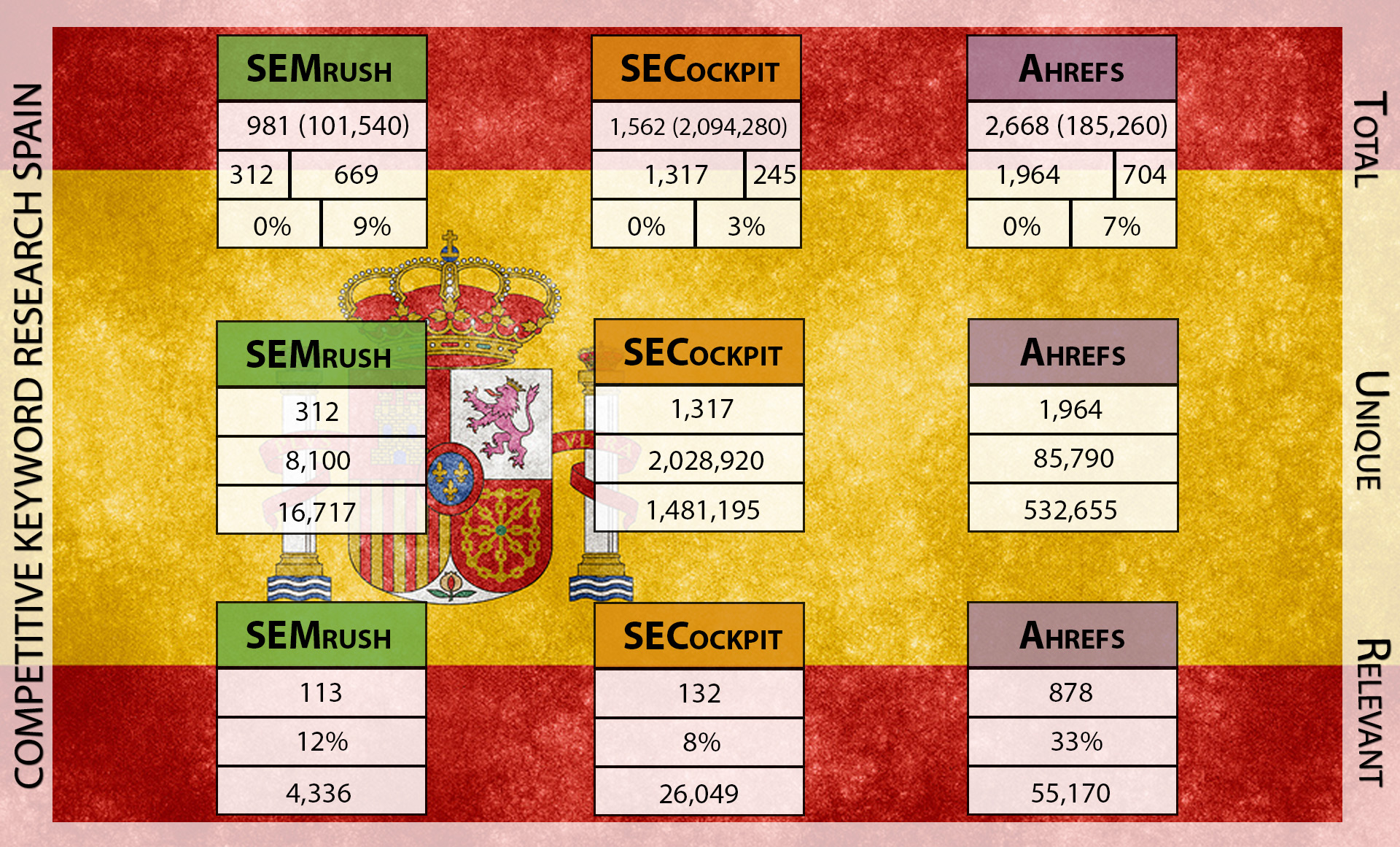

Remember to take a good look at the legend next to the data visuals:

- The 1st block of metrics refers to the total keyword output without any filtering.

- The 2nd block is all about the unique keywords with standardized search volumes.

- The 3rd block only shows metrics for the relevant unique keywords.

As mentioned, we split our analysis into traditional keyword research and competitive keyword research following the lead of Authority Hacker.

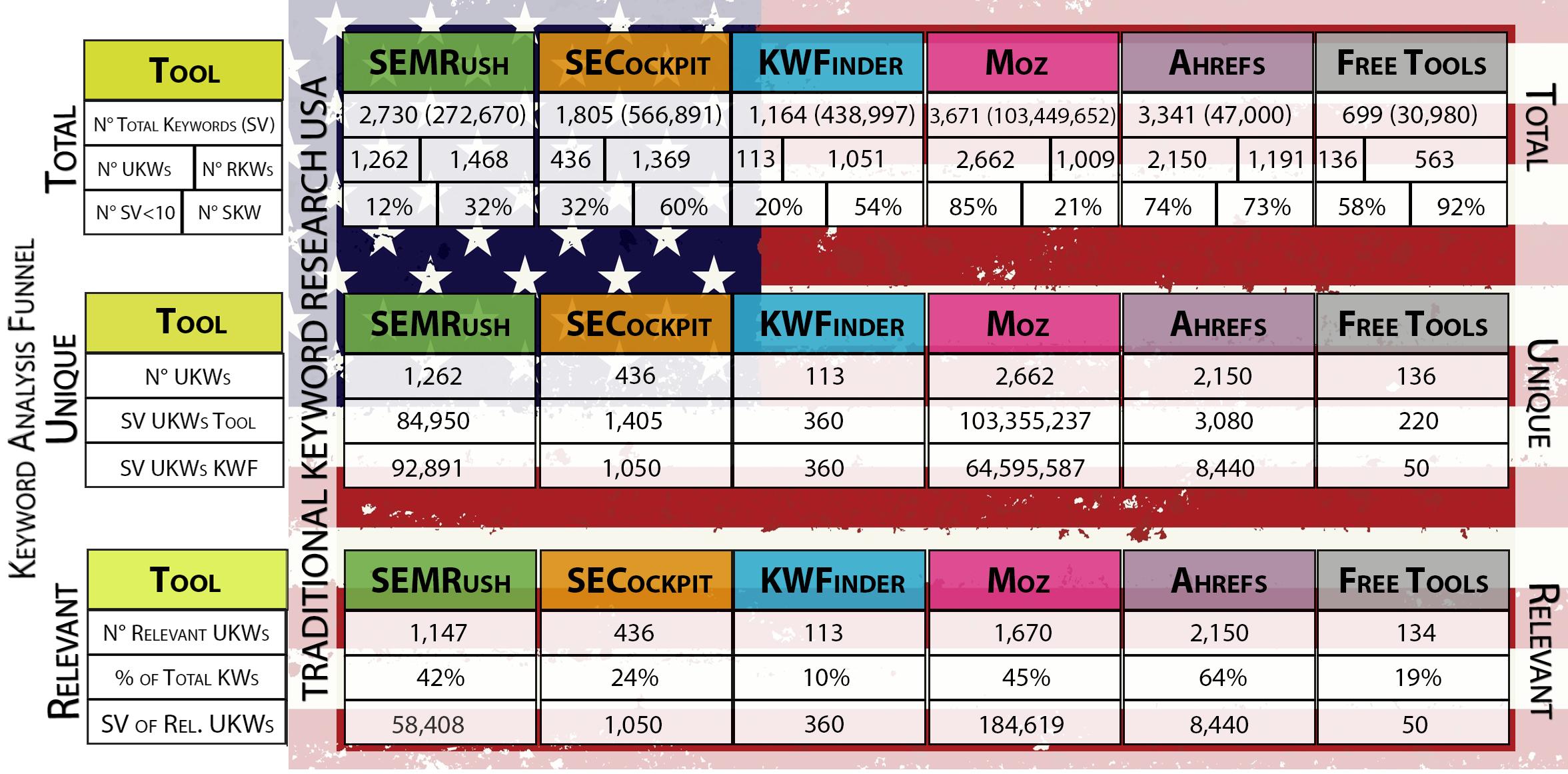

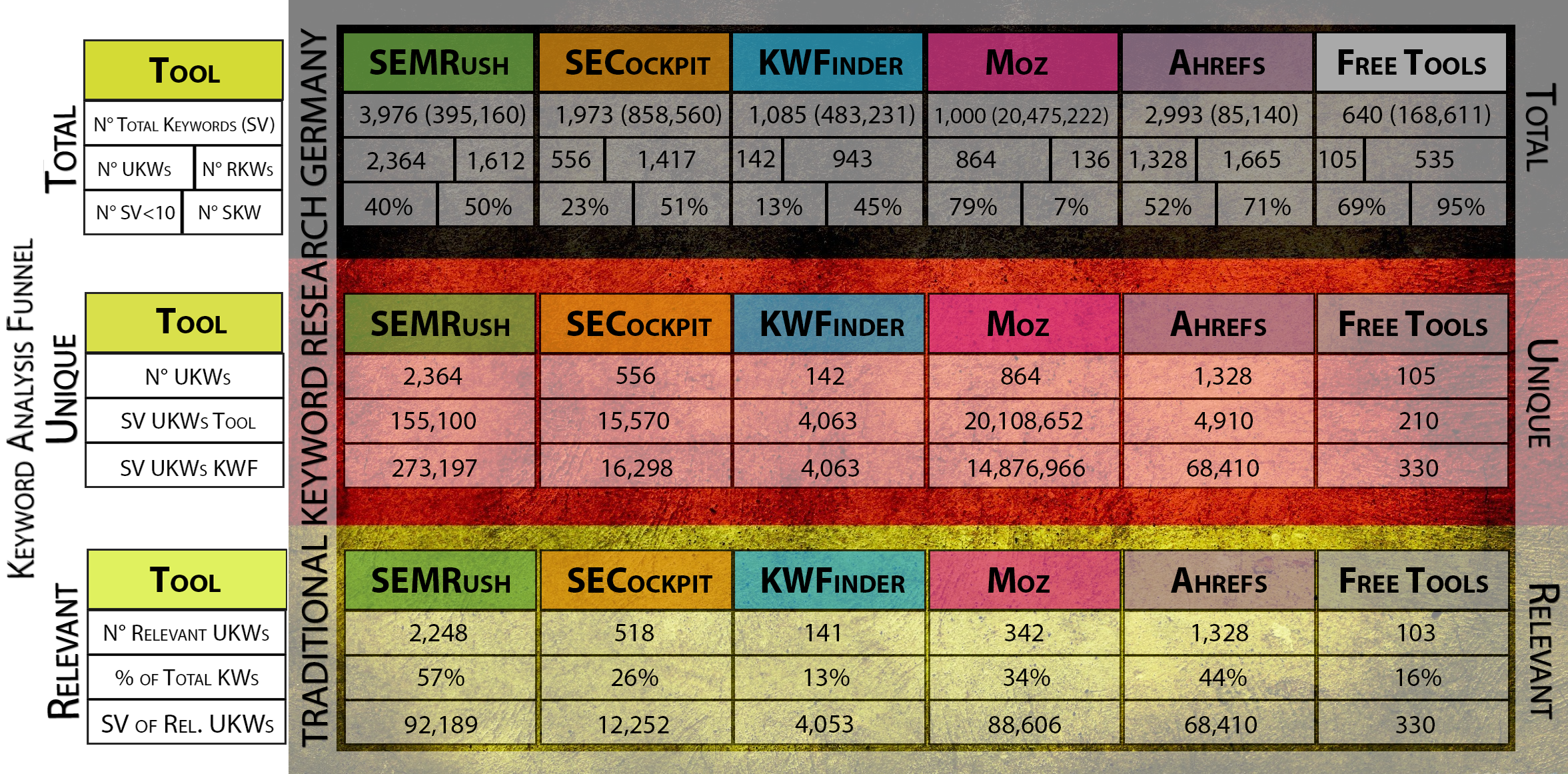

Traditional Keyword Research Results

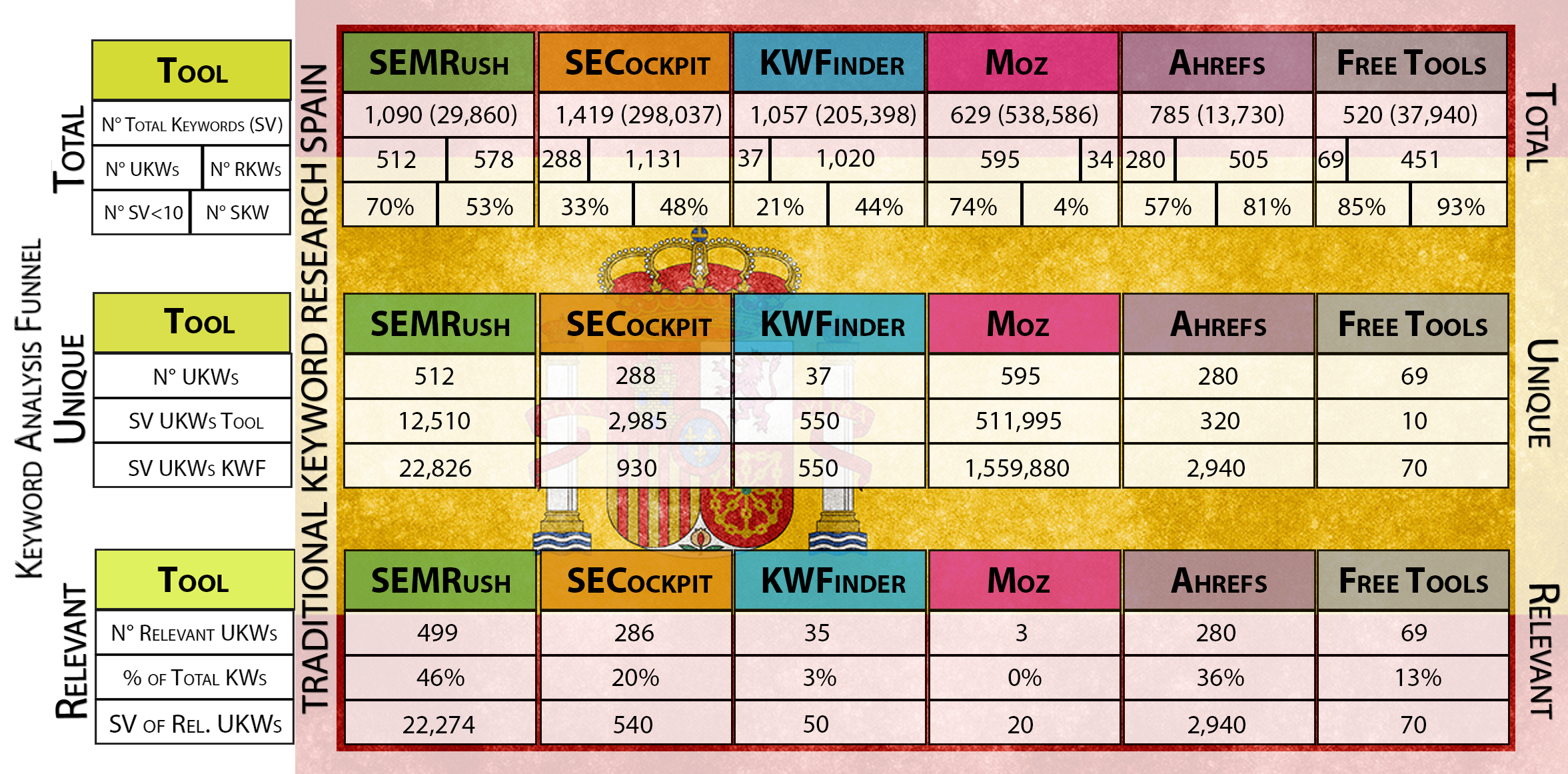

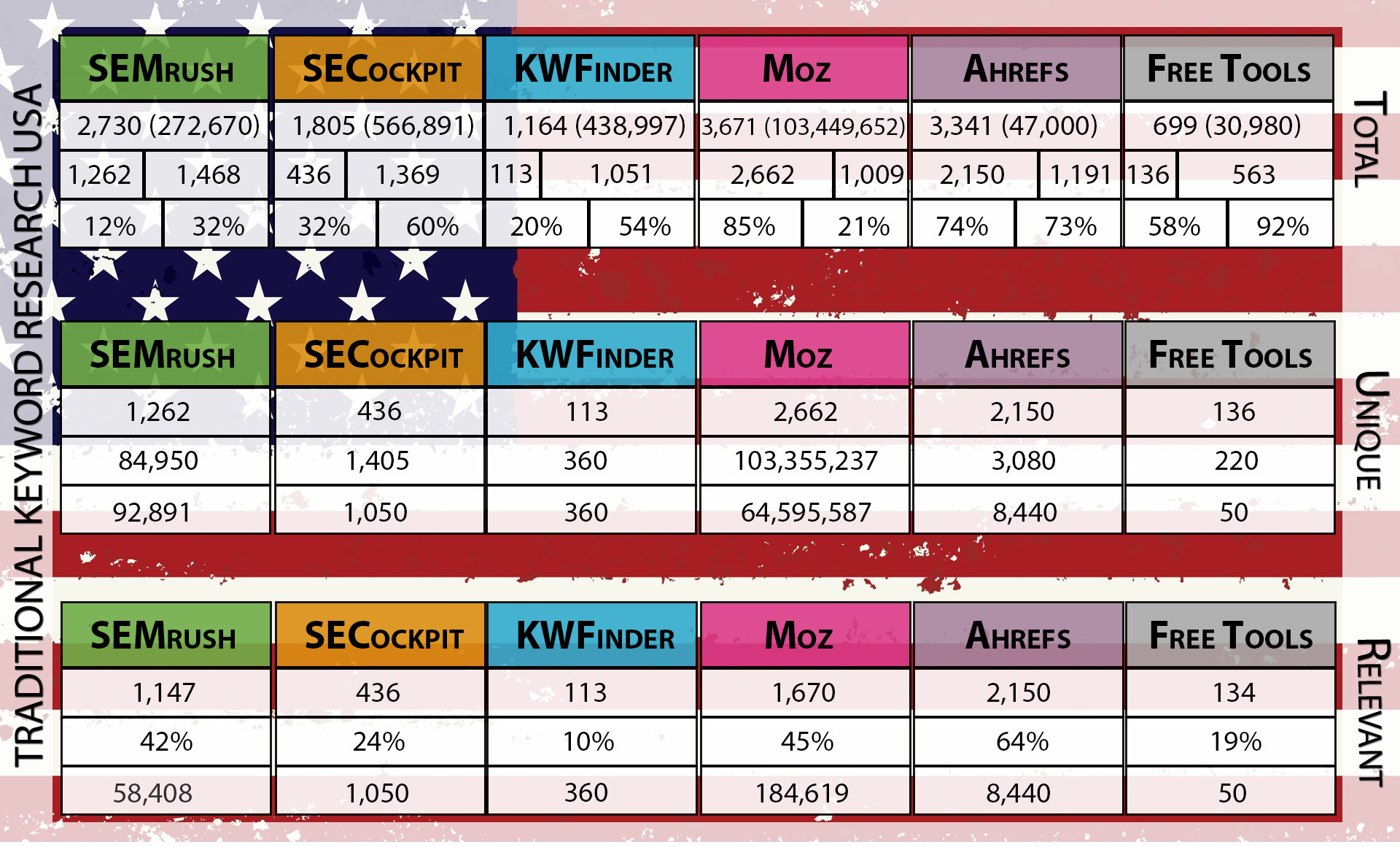

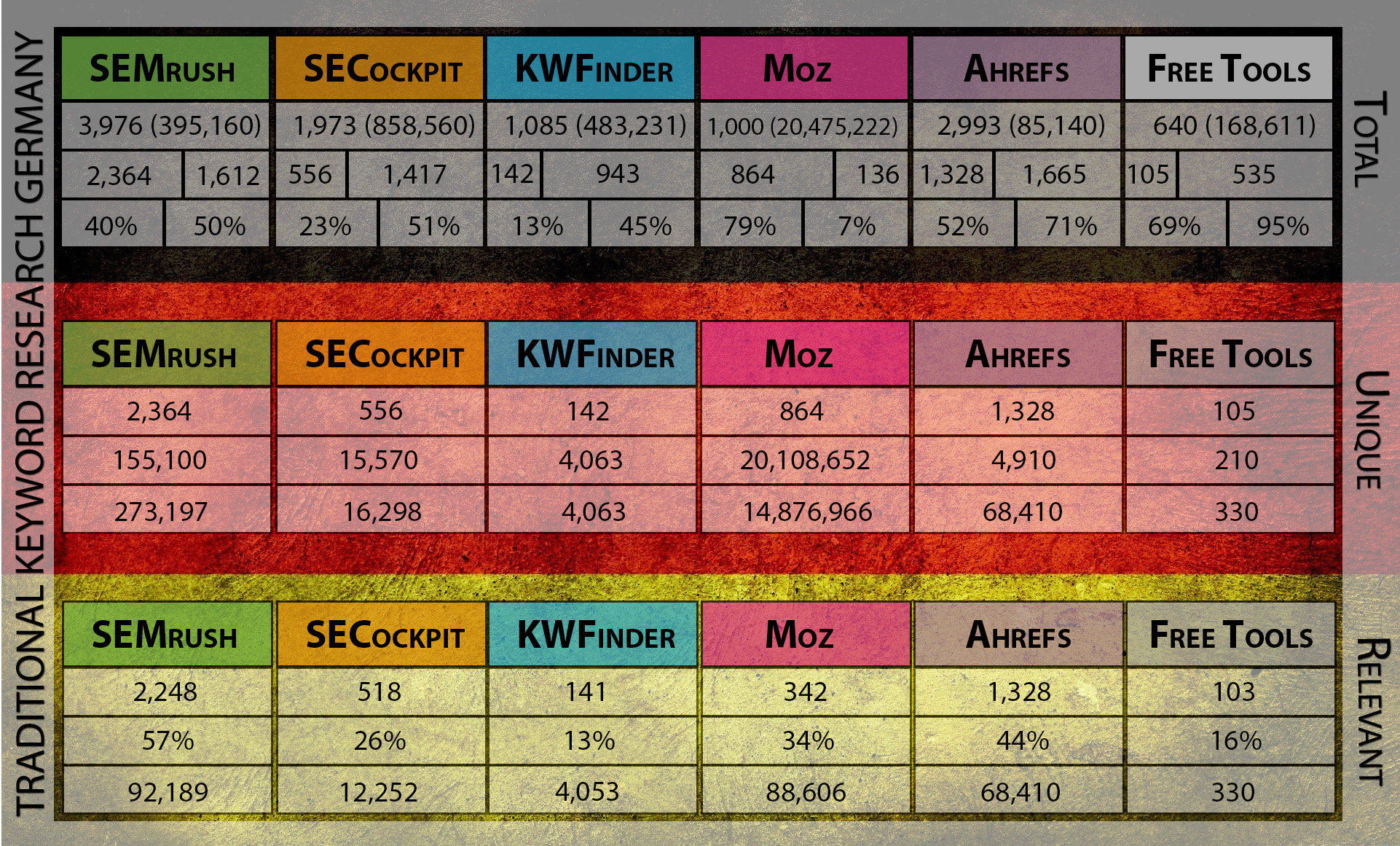

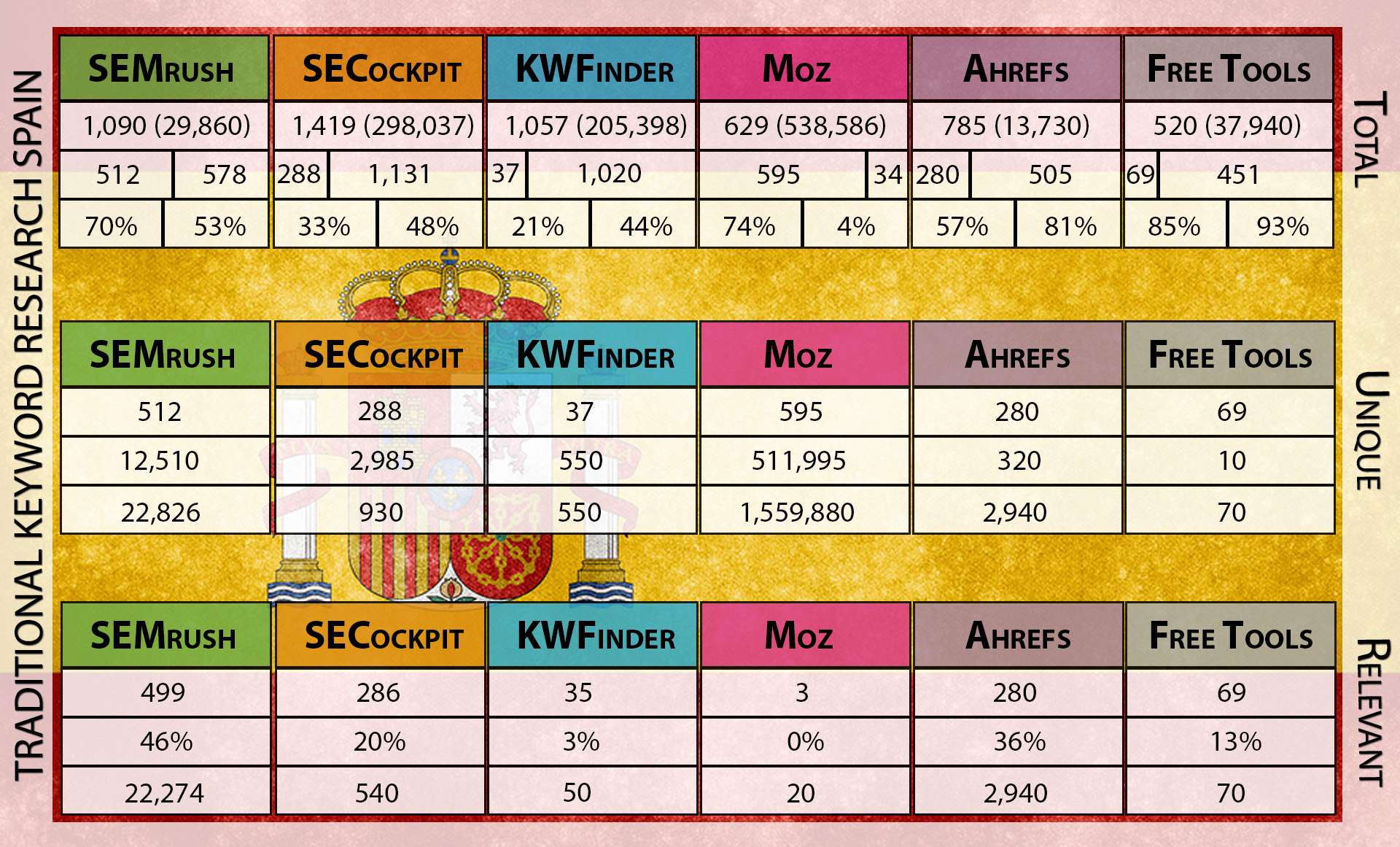

Here come the results of our traditional keyword research analysis. You can slide from country to country or zoom in on each by clicking on the thumbnails below. When we refer to data from the images, we always report it the same way:

(Metric of Tool – USA: value | Germany: value | Spain: value)

- Traditional Research Approach English

- Traditional Research Approach German

- Traditional Research Approach Spanish

SEMrush is the only tool with consistent results on an international level.

- All languages: It gave us a good amount of relevant unique keywords between 40-60% of total keywords in all languages (SEMrush Rel. UKWs % – US: 42% | G: 57% | S: 46%).

- German/Spanish: For German and Spanish keywords, it had the highest standardized search volumes of those relevant unique keywords (SEMrush Rel. UKWs SV – US: 58,408 | G: 92,189 | S: 22,274).

- English: Only for the English data, the Moz results were higher (Moz Rel. UKWs SV – US: 184,619).

It looks like SEMrush is a solid choice for international keyword research.

On to SECockpit, our tool of choice up to this point.

- All languages: The initial search volume for its total keywords (SECockpit Total KWs SV – US: 566,891 | G: 858,560 | S: 298,037) still can keep up with the other tools.

- All languages: But once you go down our analysis filter these impressive numbers quickly fade away. In each language, only around 20% of unique keywords are actually relevant to the search intention.

- All languages: The (small) remaining relevant search volume also speaks, well… volumes (SECockpit Rel. UKWs SV – US: 1,050 | G: 12,252 | S: 540).

For the traditional process, SECockpit does seem to provide not much of a competitive edge whatsoever. Maybe it will have a comeback in the competitive process?

Honestly.

The SECockpit results can almost be copied and pasted to KWFinder. You can clearly see that the Google AdWords API is pulling the strings from behind the scenes.

- All languages: KWFinder also had high initial volumes for total keywords (KWFinder Total KWs SV – US: 438,997 | G: 483,231 | S: 205,398).

- All languages: They shrink to almost nothing when you look at the supposedly competitive advantage of the tool: its relevant unique keywords.

- All languages: They make up only ~10% of total keywords (KWFinder Rel. UKWs N°- US: 360 | G: 4,053 | S: 50).

That doesn’t mean that you won’t get the basic keyword suggestions that every tool delivers. But if you’re digging for “keyword gold” only with this tool, you likely to be in for a disappointment.

Actually so much that we decided to get a subscription for it. Why? It’s economics 101: The USP of the KWFinder is not generating unique keyword suggestions. It’s the user experience.

Does that even matter as long as you get good keywords out of the tool? Yep, it does.

Keyword research tools are supposed to do one thing – save you time to save you money.

And that’s exactly what the KWFinder does by giving you a fast overview of Google metrics and SERP pages for imported suggestions.

Moz is one of the top dogs in the SEO industry. It recently lived up to its name by introducing its brand new keyword explorer tool.

As mentioned before, we focused on the English data. Not because we’re lazy. But since Moz frankly state that they only provide US data, so e.g. for German search queries, you’ll only get the volumes from www.google.COM but not from www.google.DE. At least for the time being.

In any way.

Moz’s numbers all tell the same story – be it for the English, German or Spanish data.

- All languages: First, you’ll notice the astronomically high search volumes of total keywords. Those seem to outperform all other tools by far (Moz Total KWs SV – US: 103,449,652 | G: 20,475,222 | S: 538,586). But once standardized, cleaned for merged data and sorted for relevance, that quickly fades away.

Again.

- English: On top, the final volumes for our relevant unique keywords metric reflect the fact that Moz works best for US data (Moz Rel. UKWs SV – US: 184,619 | G: 88,606 | S: 20).

- German: You might say that 88,606 total searches for Germany aren’t THAT bad of a number. Right. Now take a look at the volume of the two top relevant unique keywords (“deutsche welle” – 49,500 | “goethe institute” – 22,200) and you’ll clearly see why.

Are they relevant? Yes, but almost impossible to rank for as well!

Now. Do our numbers suggest that Moz is the best tool for English countries?

Only maybe.

Be aware of the fact that Moz provides you with data ranges similar to Google Keyword Planner. We averaged the ranges to include them in our comparison but as you can imagine that was pretty much a wild guess in many cases.

Seems like Ahrefs comes in second after SEMrush for the traditional keyword research.

- All languages: It delivers a good percentage of relevant unique keywords of total keywords (Ahrefs Rel. UKWs % – US: 64% | G: 44% | S: 36%).

- All languages: Get this. There was not one single irrelevant keyword in the traditional Ahrefs reports. So you don’t have to weed out keyword suggestions that are off-topic and can save some money.

- All languages: Still, many of the suggestions have low or no search volume. That’s also reflected in the total search volumes of its relevant unique keywords (Ahrefs Rel. UKWs SV – US: 8,440 | G: 68,410 | S: 2,940). Especially in the English and Spanish data.

Low search volumes mustn’t be a bad thing in itself.

Actually, it might be exactly what a local SEO is looking for: many relevant keywords, even with low search volumes. So be aware of that. For a comparison with low-volume, local seed keywords Ahrefs could be the frontrunner.

But that’s a whole other story – or study. One that we will definitely conduct in the near future! Sign up here if you don’t want to miss out on it.

So far so good, now the free stuff!

Time to come to finish this category with the combination of Free Tools that we used.

- All languages: If you take a swift look for yourself, you’ll already see that their numbers lag behind other tools.

- All languages: Not significantly in the N° of total keywords (Free Tools Total KWs N° – US: 699 | G: 640 | S: 520).

- All languages: But definitely in the search volume of relevant unique keywords (Free Tools Rel. UKWs SV – US: 50 | G: 330 | S: 70).

And the misery doesn’t stop there. After all, everything free comes with problems.

If it’s for free, there’s a catch.

Have you ever made that experience? Well, for us and our international approach that has proven to be true.

Keywordseverywhere actually gives you the option to search for global volumes. But on a country level, you only have the English-speaking nations.

So it’s no wonder that the German and Spanish searches coughed up almost no useful keywords. That’s probably also the reason why the tool doesn’t deliver data for keywords with special characters. Have a look: When you import them, the special characters are skipped in the results.

For English data that’s not such a big deal though since the language barely has special characters.

So if you only work with the English market, an approach with Free Tools is doable. Not so much in different languages.

In any way, we want to give a shout-out to the developer of the tool though. He communicates straight up that it only works for keywords in English. He also was super responsive and fixed an issue for German browsers right away, after we brought it to his attention.

Our key takeaways from these results:

SEMrush followed by Ahrefs are the frontrunners in providing unique and relevant keywords for the traditional approach. Moz would probably play in the same league if they were set-up more internationally and provided precise numbers.

For SECockpit, KWFinder and the Free Tools our results suggest that they’re not the best at finding unique keywords. As tools with a Google AdWords API they mainly cover repeated keywords.

Competitive Keyword Research Results

Ready, set, go! We’re getting competitive now.

This part is all about spying on the tactics of our competitors. Which tools can help us to get our hands on their top ranking keywords? With them, you easily can estimate your odds to rank and avoid potential frustrations.

Now before we report the data. Here’s something to think about:

“If we put the same top 10 SERP URLs into each tool shouldn’t they scrape exactly the same keywords from those pages?”

Made sense to us at least. But *yet another spoiler* we were proven otherwise. There are indeed differences in the data that the tools give you. Just take a look.

- Competitive Research English

- Competitive Research German

- Competitive Research Spanish

Ahrefs is in the pole position here.

- All languages: First off, it has the highest search volume for its relevant unique keywords compared to the others (Ahrefs Rel. UKWs SV - US: 84,750 | G: 148,167 | S: 55,170).

But it’s not just about that. Is there another reason why Ahrefs is the best tool for competitive research? Yup.

- All languages: Just look at the % of how many unique keywords of total keywords are actually relevant! (Ahrefs Rel. UKWs % - US: 33% | G: 38% | S: 33%)

It’s always around a stable third for Ahrefs while it fluctuates for the other tools.

That's the same experience we made in the traditional keyword research.

And again for you, that means:

You’ll have to sift through less irrelevant results before finding keyword pearls. Those that truly matter to your business.

- All languages: Finally, don't forget the fact that you only need one click to extract the competitive report with Ahrefs.

Then it should be clear why we declare Ahrefs the winner of this discipline.

This time SEMrush finishes in the second place together with SECockpit.

- All languages: It performs fairly good for English and German data but worse for Spanish (SEMrush Rel. UKWs SV - US: 52,469 | G: 63,365 | S: 4,336).

Unlike for Ahrefs competitive research is quite a hassle with SEMrush. To export and combine all the data for the SERP top 10 URLs, it’ll take you around 30 minutes.

This is actually one of our main take-aways of this SEO case study. We initially thought that the tool’s strong suit is competitive research.

But the number proved us wrong.

- All languages: SECockpit is around the same level as SEMrush. But it falls behind with the English keywords (SECockpit Rel. UKWs SV - US: 13,519 | G: 119,830 | S: 26,049).

- Also take a look at the number of repeated keywords (SECockpit Repeated KWs N° - US: 271 | G: 820 | S: 245).

It's always lower compared to the other tools. This could mean that SECockpit didn’t scrape keywords from the SERP top 10 URLs that Ahrefs and SEMrush did. This performance comes with inconvenient waiting time to load many results. In the end it, it also took us around 30 minutes to scrape all the SERP top 10 data.

All in all, Ahrefs is clearly the winner of this category. Why? Because it’s fast and provides the most relevant suggestions. SEMrush and SECockpit follow with comparable quality of keywords but their inconvenient waiting times are their main drawbacks.

Global Statistics

On a final note, we didn’t want to hold back these two interesting statistics. Keep in mind that we are taking a look only at English data from traditional research.

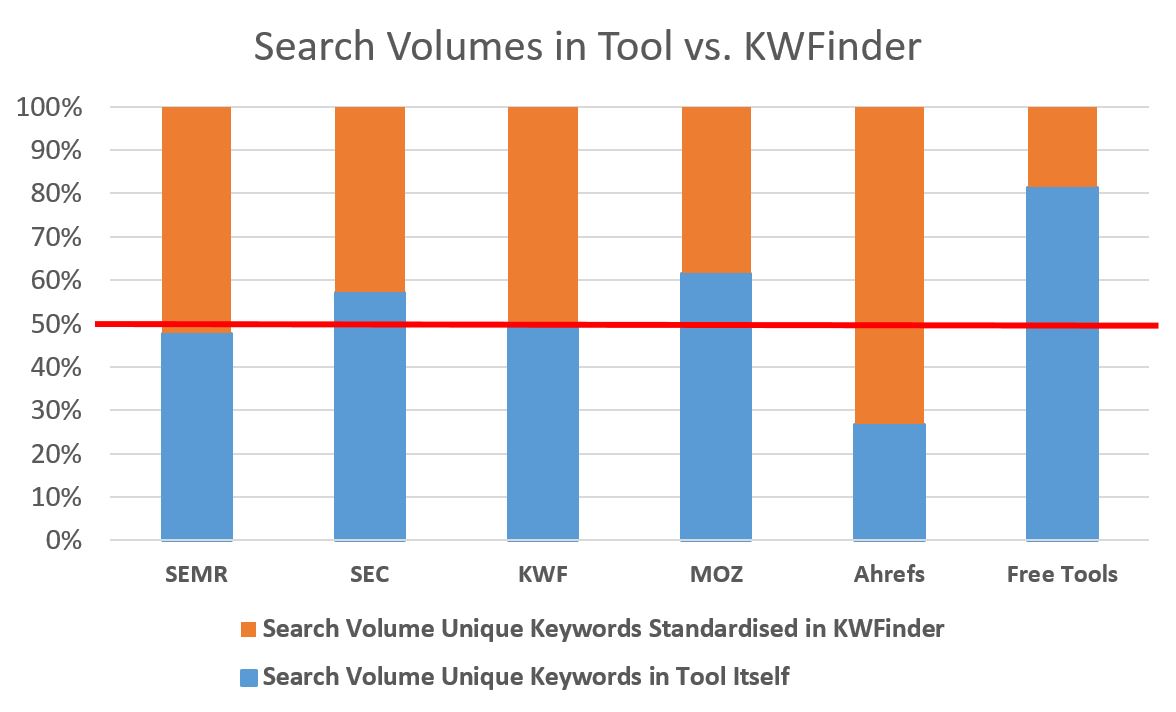

Standardised Search Volumes

The first statistic shows a comparison of the search volumes that the tools assign to their unique keywords (orange part) and the volume that those unique keywords have in KWFinder (blue part).

Ahrefs seems to underestimate its volumes. SECockpit and Moz slightly overestimate it. It goes without saying that KWFinder stays at the same numbers with an exact 50-50 split in this figure.

SEMrush also averages at the 50% split. But a look at the numbers will show you that its volumes fluctuate around the KWFinder numbers: sometimes they are more - sometimes less.

Results General Statistics

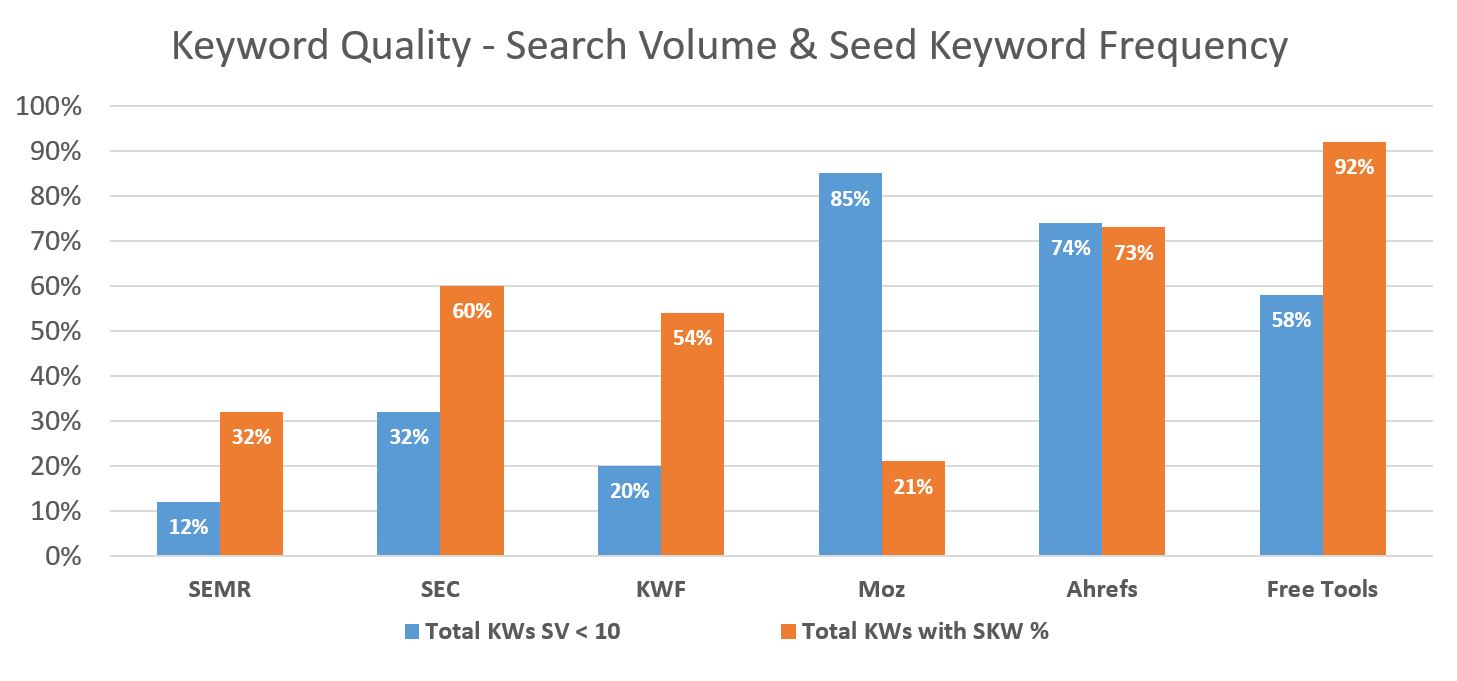

The second one takes a look at the percentages of total keywords across tools:

(1) KWs SV < 10 - How many % of the output that has a search volume below 10?

(2) KWs with SKW - How many of the total keywords are a variation including the seed keyword, i.e. simply add another word before or after?

As you can see, the graphic reflects the trends from above:

For example, that Moz and Ahrefs have many suggestions with no or low search volume. At the same time, Moz suggestions seem to be very original since they only include the seed keyword a few times. Unlike the Free Tools.

SEMrush, SECockpit, and KWFinder all have a similar trend: Few keywords with low data (12% - 32%) and a medium amount of keywords expanding upon the seed keyword (32% - 60%).

What does all of that mean for you?

SEMrush is quite low in both numbers which speak for the quality of its suggestions. Again, in Ahrefs the high % of low volume keywords may be exactly what you need as local SEO.

Finally, Moz seems to be a promising tool to keep an eye out for in the future!

For our services, it’s so far not a suitable primary tool but a good addition to the English speaking data.

Now we’re on the home stretch.

You made it all the way here, so congrats to you! Or were just smart enough to skip to the best part?

Because here we'll present you the main takeaways from what we’ve talked about so far. So let’s get to the bottom line of this comparison and recap!

How did we start out?

With a combination of the tools: SEMrush and SECockpit.

What was it that we wanted to know?

We were looking for the best keyword research tool that fits our needs as an international company with global clients.

And are we any smarter now?

Hell yes. We now have a better insight into how the tools work and how we can use them efficiently for our services.

Of course, we also picked the tool we’ll use from now onward. Actually, there is more than one!

Introduction Recap

In the Introduction we told you about…

SEOintheSUN is a digital marketing school and agency and actually part of the FU International Academy, a company based in Tenerife (Spain) with a couple of different offers for international clients. Our main languages are English, German and Spanish.

Since we get students and clients from all around the world, our best keyword research tool needs to show us global search volumes across all territories.

Before we’ve used SEMrush and SECockpit for our keyword research but wanted to challenge our choice.

This study is all about the broad seed keyword “learn german”. We analyzed it in English, German (“deutsch lernen”) and Spanish (“aprender aleman”).

So you’ll get a quantitative comparison in 3 languages of the search volumes of 5 paid and 1 combination of Free Tools in the language school niche.

You’ll not get an intro to all the tools’ features nor an assessment of their keyword difficulty metrics.

We used tons of terms that may be hard to grasp if you're new to the topic. If you’re in doubt just go up to the glossary and read the definition.

Literature Review Recap

The Literature Review was all about...

SEO tools compete against each other. That makes it hard to build a lasting knowledge base. Why would you share your secrets?

Yes, there is an incentive to publish outstanding content to rank in front of your competitors. But the fast-moving nature of the field (i.e. Google updates) might invalidate these studies and casts doubts over their accuracy.

There are many SEO and keyword research studies out there.

Backlinko published a great list of SEO Tools. You can filter the list for free, paid or freemium keyword research tools as well.

Authority Hacker gives you an overview of many tools and their functions. It also shows you the difference between the traditional and competitive approach to keyword research. We applied this in our method.

Workshop Digital recounts how practitioners use keyword research tools in an agency. The main lesson: There isn’t THE one perfect tool. Rather it makes sense to combine several.

But none of the articles did exactly what we did. Looking for DATA & STATS to back our decision for or against specific tools.

There are two main ways how keyword research tools source their data.

(1) Some (KWFinder, SECockpit, Free Tools) use only the Google AdWords API to source their data while others, especially big players like Moz and Ahrefs, (2) use clickstream data to go around and improve that data.

Why? Because access to the Google AdWords API is tied to requirements. Plus it comes with the dirty secrets of the Google Keyword Planner like grouped search volumes of close variants.

As you’re probably painfully aware of, Google gives less and less information to SEOs. To be independent, Moz and Ahrefs use clickstream data estimates to calculate more accurate search volumes.

Clickstream data, in essence, captures the behavior of visitors and their clicks online.

Method and Analysis Recap

In the Method and Analysis sections, we walked you through our process to…

We made three main assumptions about our (1) Seed Keywords, (2) Unique Keywords and (3) Relevant Keywords.

First, we used broad seed keywords (“lean german”, “deutsch lernen” and “aprender aleman”) from the language school niche.

Then we defined the Unique Keywords of each tool as their Unique Selling Proposition, i.e. their competitive edge they have over the others.

Finally, we checked if those unique keywords are also relevant. We decided that Relevant Unique Keywords are the ultimate metric to compare the quality of keyword suggestions.

One thing that we’ve established at this point: Keyword data is a mess.

To make it as comparable as possible, we gave ourselves clear guidelines.

We always used the same settings and extracted all reports for each tool. Also, we split our analysis into traditional and competitive keyword research. This way tools without competitor based reports weren’t at a disadvantage.

To analyse our data, we always used the same filter - for traditional keyword research just as well as for competitive keyword research.

- Input on Top: “Total Keywords”

- Step 1: “Select Unique Keywords”

- Step 2: “Standardise search volumes”

- Step 3: “Check Relevance”

- Output on Bottom: “Relevant Unique Keywords”

Results Recap

Now the grand finale. We decided to put the Results directly into the context of the tools. This way you get a brief summary of each.

Yup, SEMrush stays one of our top choice keyword research tools. Its main facts:

Worldwide Search: no, only country-specific

Data Source: own database

Competitive Research: yes

Basic Monthly Price: 99€+

Usability and Speed: Good user interface and very fast search results.

Traditional Keyword Research

You can extract three reports and still need to combine into one list.Competitive Keyword Research

You need to put all SERP top 10 URLs into the tool, export the results and combine the excel files after. It’s more time-intensive (~30 mins).Pro: Relevant unique keywords with solid search volumes across all languages.

Con: Rather slow competitive research process and focus on high volume keywords.

We did subscribe to KWFinder even though it performed poorly in our comparison of relevant unique keywords.

The tool only gives you basic keywords suggestions. BUT it delivers you metrics for any keyword you import. And it does so at any geographical level and with an incredibly convenient user interface. What we value most: To be able to compare all our data by standardizing it in KWFinder.

The tool in a nutshell:

Worldwide Search: yes

Data Source: Google API

Competitive Research: no

Monthly Price: Basic (45€) | Our plan: premium (65€)

Usability & Speed: Great user interface and fast results!

Pro: Great user interface and access to global data.

Con: Basic suggestions but rarely finds unique keywords.

Ahrefs is a solid tool to generate your keyword suggestions. Especially when you look at its competitive research report.

It’s incredibly convenient to get everything you need in just one click.

Overview of Ahrefs:

Worldwide Search: no, only country-specific

Data Source: own database (Google & clickstream data)

Competitive Research: yes

Monthly Price: 99$+

Usability & Speed: Good user interface and fastest way to do keyword research with an all-in-one report.

Traditional Research

You can extract three different reports and need to combine them if you don’t want to mix them with competitive results.Competitive Research

You get the competitive SERP top 10 keyword suggestions with just one click!Pro: It’s fast and has the best results for the competitive research approach. More relevant keywords than other tools, even though often with low volumes.

Con: Only has country-specific search and was outperformed by other tools in the traditional keyword research.

Moz is not our cup of tea at this time for one simple reason: It doesn’t give good suggestions for international data!

And as you read above, they are fully transparent about the fact that at the moment they mainly cater to the English market.

What it's all about:

Worldwide Search: no, only country-specific

Data Source: own database (Google & clickstream data)

Competitive Research: no

Monthly Price: 99$+

Usability & Speed: Nice user interface and instant results. However, the 7 different reports have to be exported and combined manually.

Pro: Promising approach with high % of relevant unique keywords in English. Delivers some good and creative ideas that don’t include the seed keyword.

Con: No international data and no data for many suggestions. Data is shown in bucket format like in Google Keyword Planner.

We started with SECockpit but decided to drop it as a tool because it's simply too time-consuming. And does not deliver convincing results to make up for that.

In summary:

Worldwide Search: yes

Data Source: APIs from different sites like Google, Amazon & Youtube

Competitive Research: yes

Monthly Price: 30€+

Usability and Speed: Rather old-fashioned user interface. Tab system is useful but searches are often very slow!

Traditional Research

You get one consolidated report with all keyword suggestions from all the sources that you selected before.Competitive Research

You need to put all SERP top 10 URLs into the tool. You can expand your keyword list but the process for 10 URLs is still quite time-consuming (~30 mins).Pro: many filters and useful expand function: no need for combining excel tables

Con: very slow and no convincing numbers in our analysis filter

The Free Tools for keyword research delivered as expected.

You can find some of the standard keywords that you get across the board. But you'll barely see any Relevant Unique Keywords with notable search volume.

The main facts:

Worldwide Search: yes

Data Source: Google API

Competitive Research: no

Monthly Price: 0€

Usability & Speed: Speed great but usability not. It usually takes more than one tool to get suggestions and the corresponding metrics.

Pro: For free and sufficient for very basic searches in the English market.

Con: Limited results compared to other tools with basically no unique keywords. Only English-speaking data and the need to juggle several excel files.

There you go. SEMrush, KWFinder, and Ahrefs it is for us.

Our primary combination.

Now the ball is in your court.

Do you agree with our method and findings? Would you have done something differently?

We’d be happy to take your ideas and feedback into account in our next study. Because let’s face it: We’re not all-mighty and always look for ways to improve our content, processes, and services.

Subscribe to our newsletter and stay informed about everything that we have in the pipeline:

New studies. New SEO services. New how-to blog posts.

Don't forget: You can get this SEO study as eBook!